Paraguayan beef trade to decline in 2025 - GAIN

New markets in US and Canada open to Paraguayan beefParaguayan beef exports in 2025 are forecast at 450,000 tons cwe, down 4% from the previous year mainly because a drop in beef supplies, according to a recent US Department of Agriculture (USDA) Global Agricultural Information Network (GAIN) report.

The recent opening of the US and Canadian beef market has brought a lot of expectation to the sector, which is forecast to expand shipments to these two countries in 2025. Being eligible to export to these two markets which demand high sanitary standards helps Paraguayan exporters show that their beef products are reliable. Local meat packers believe this new status will help open new markets.

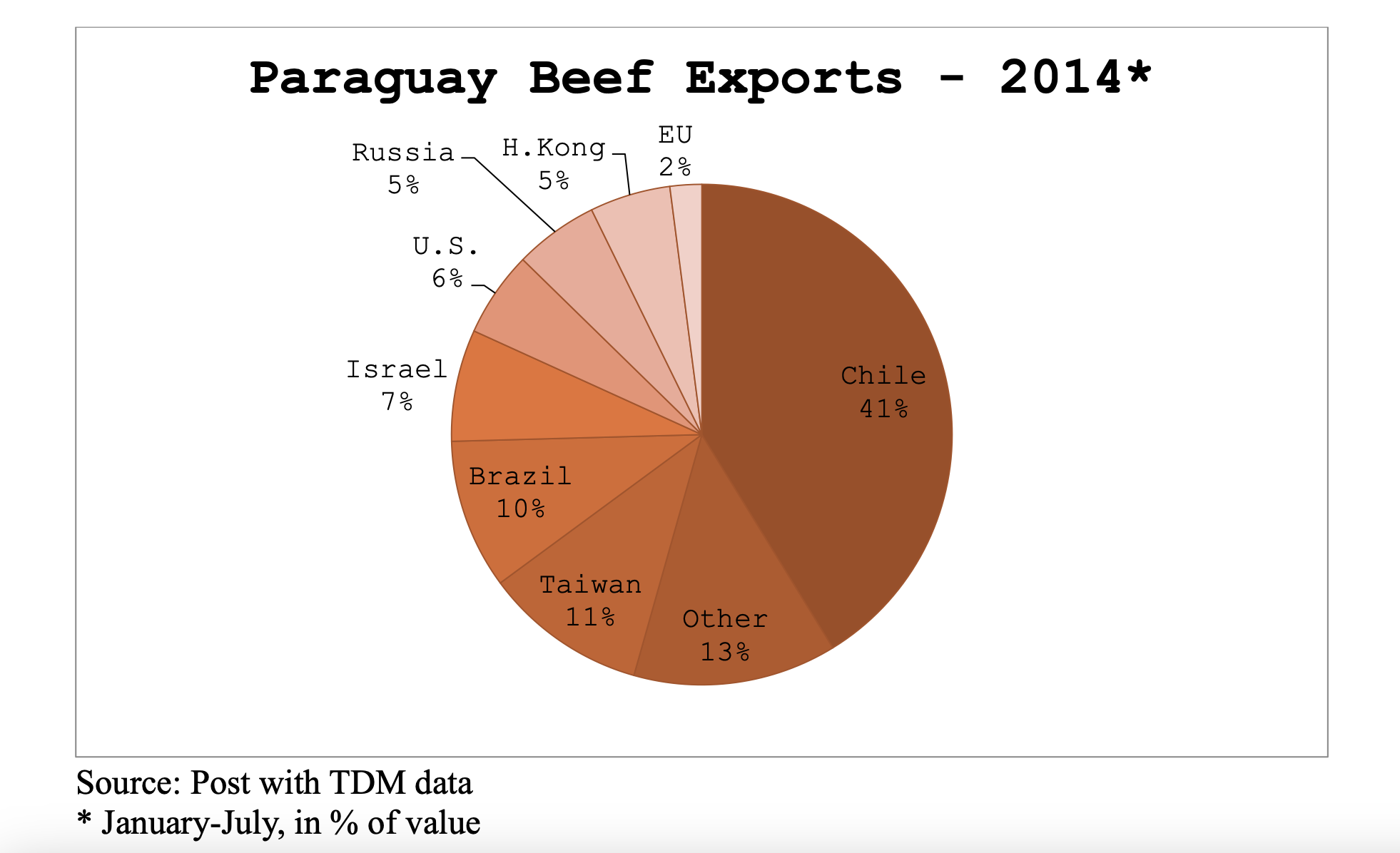

In the first seven months of 2024, Paraguay exported 195,000 tons cwe of beef (product weight), 4% higher than in the same period last year, to more than 50 markets. The total value was $940 million, with the main markets being the following:

The main products exported were frozen boneless beef, with Taiwan being the leading destination, followed by Russia, Hong Kong, Israel, the US and Chile. Exports of boneless chilled beef were also very important, with Chile the main destination, followed by far by Brazil and Uruguay. Exports of frozen bone in beef have always been negligible, with Singapore as almost the exclusive destination. Since February 2024 Israel authorized the importation of bone-in beef with small but growing volumes.

Based on TDM data, Paraguay’s average FOB price in the first seven months of 2024 was $4,831 per ton, practically unchanged from the same period a year ago and 8% lower than the same period two years ago. Although Paraguay is not eligible to export beef to China, the drop in prices in that market affects directly the prices exported by Brazil, its main supplier. Brazil then searches for other markets which pay better prices and puts pressure on markets which Paraguay exports to such as Chile, Russia and Israel.

Chile is Paraguay’s main destination for beef by far and it is expected to continue in 2025. Chileans import roughly 50% of their beef from Paraguay. Brokers believe demand will remain quite stable in 2024 and will present good opportunities next year. Current average beef prices are somewhat weaker than a few months ago, with Brazilian beef putting somewhat downward pressure. Chile normally buys 20 cuts from the carcass, boneless and chilled. Importers are typically meat packers, importers, distributors and supermarkets. Beef sales in August and September are strong for their national festivity in mid-September and increase again in November and December in preparation for end of year holidays.

Taiwan is projected to remain the second largest market in 2025, but probably with a lower volume as other markets are expected to pay higher prices. Paraguayan beef enters Taiwan duty free and, since 2020, free of quotas. It accounts for 20-25% of Taiwan’s beef imports (measured in volume). Most products are frozen boneless forequarter cuts. Paraguay also exports ribeye, chuck tender, oyster blade, shin shank and knuckles. Exports of chilled cuts are marginal due to its long transit time.

Brazil is expected to continue to be a significant market in 2025, due to the strong relation between meat packers in both countries. However, exports in 2024 and 2025 are forecast to drop somewhat as Brazilian beef is very price-competitive. The main cut exported is chilled cap of rump, the most popular cut there, consumed typically in barbecues and steak houses.

Israel is a growing market for Paraguayan beef. It primarily imports kosher boneless forequarter cuts, but a few months ago allowed the importation of Paraguayan bone-in beef. It also imports small volumes of high value chilled cuts. Based on TDM data, Israel’s beef imports from Paraguay in the first half of 2024 increased more than 50% (in value) as total beef imports increased and exports from other sources diminished significantly compared to a year ago.

Exports to the Russian Federation, Paraguay’s number one market not too long ago, are projected to continue to decline as there are only three plants eligible for export and the demand from the recently opened markets in North America currently pay more for similar cuts for industry use. Exporters also indicate that payment and logistical issues remain a concern.

The European Union is an important market as it provides Paraguay with a 1,000 ton Hilton Quota of high premium chilled cuts at high prices. On December 30, 2024, this market will have in practice Regulation 1115 of deforestation by which imported food products need to demonstrate that they were originated in operations which were not deforested after 2020. The beef sector in Paraguay is quite confident that either an official or private certification will accompany future shipments of beef and that they will not have problems to enter.

The US market for Paraguayan boneless chilled and/or frozen beef is opened since December 2023 when two containers were exported. Exports to the US in January-July 2024 totaled 11,492 tons product weight, ranking 7th in destination for Paraguayan beef. Local meat packers expect total exports in 2024 at about 25,000 tons (product weight) because of the strong need the US has for beef and to help to keep inflation under control.

Brokers believe exports in 2025 could total 35,000 tons, becoming a key market because of its volume and value. The main products exported are frozen, boneless forequarter lean beef blocks. Paraguay also exports some cuts such as inside or topside.

To enter the United States, Paraguayan beef can make use of a low tariff rate quota for “others” of 65,005 tons, issued on a first- come, first-served basis, but where Brazil operates aggressively and takes most of it in the first few weeks of each year. Brazilian meat packers normally have large volumes of beef in-bound to enter the US market rapidly.

Some traders believe that in 2025 Paraguay could make use of about 10-20% of the “others” quota, while the rest of the beef exported from Paraguay would have to pay 26.4% import duty. Even with this duty, prices are competitive enough with other alternative destinations such as Taiwan and Russia.

The Canadian market opened in mid-May 2024, a few months after the access to the US market. It is a market very similar to the US. These two markets allow Paraguayan beef exporters to explore and diversify their exports. In mid-June the first cargo with Paraguayan beef left for Canada from a slaughter plant operated by a Mennonite community. Local brokers estimate that 3-4,000 tons product weight could be exported in 2024, being primarily frozen lean forequarters beef blocks. Prices are similar to those paid by US importers.

The opening of the Mexican market is expected with anxiety by local meat packers due to the significant volume it imports. Brokers believe that Mexico could import larger volumes of beef while exporting its beef duty free to the US. Exporters hope to have this market open during the first semester of 2025 once the new government takes office. In mid-May a Mexican sanitary mission came down to audit the same 9 local plants which are eligible to export to the US and Canada. The governments of Paraguay and Mexico continue to work on the sanitary equivalency.

The government together with the local beef industry is slowly moving to open the Japanese and Korean markets in a medium future. They are also focusing in opening Singapore and Indonesia, as well as having Taiwan allow the importation of bone-in beef.

Imports of beef in 2025 are projected at 18,000 tons cwe, the highest ever. Local supermarkets have started to import beef directly, putting beef cuts on the shelves which are well accepted by consumers. Most imports come from Brazil and small volumes from Argentina. They are mostly chilled cuts and some frozen ones, such as ribs which are imported in significant volumes.