Mounting requirements causing uncertainties in EU beef sector

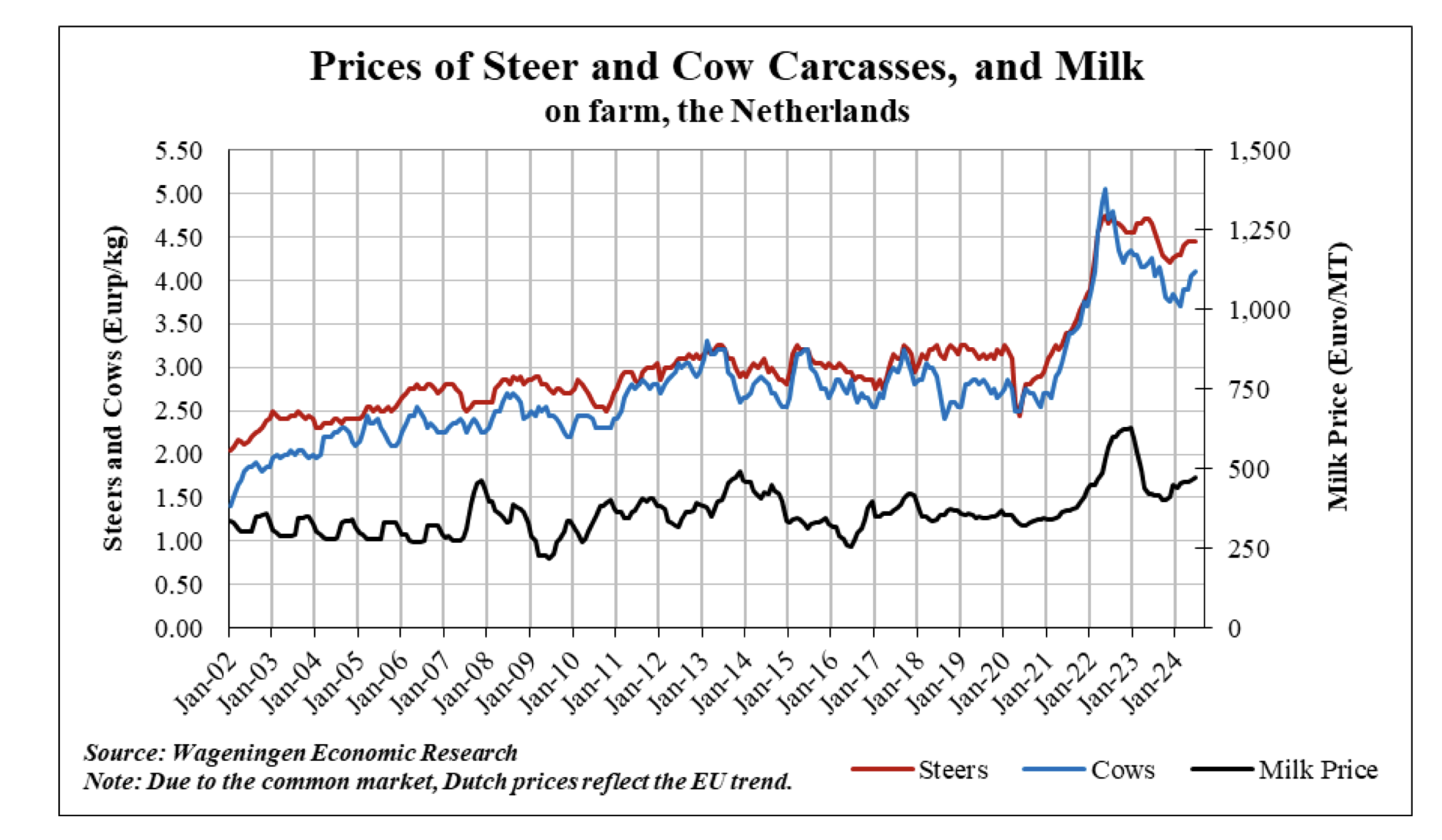

EU beef cow herd forecast to further shrink in 2024While EU beef and carcass prices have soared since 2021, the structural unprofitability of the beef sector has been further exacerbated by high energy prices, high interest rates, labor shortages, and the lack of generational successors for the farm, according to a recent US Department of Agriculture (USDA) Global Agricultural Information Network (GAIN) report.

As earlier outlined in the Semi-annual, new EU regulations are creating investment uncertainties for farmers, especially those related to the Green Deal, the Veterinary Medicine Legislation, and the new EU Animal Welfare Legislative Roadmap (for more information see the Policy section of this report). The continuous flow of new requirements imposed by the European Commission (EC) are requiring financial investments and a change of farm management, pressing profit margins even further. Pressure is not only exerted by the EC but also by private actors.

In Germany, for instance several big retailers are participating in a voluntary five-stage standardized farming method labeling scheme and have announced that they will consequently source their meat and animal products from farms fulfilling the requirements of the higher stages. One of them is Lidl which declared to source the entire range of fresh beef and milk from German farms that adhere at least to level three of the five-level animal husbandry system by the end of 2024. As a result of the mounting requirements, there is considerable insecurity among cattle farmers. Due to these market and policy factors, the total EU beef cow herd is forecast to further shrink in 2024. The most significant reductions are forecast in France, Spain, and Ireland.