Australian milk production forecast to rise in 2024

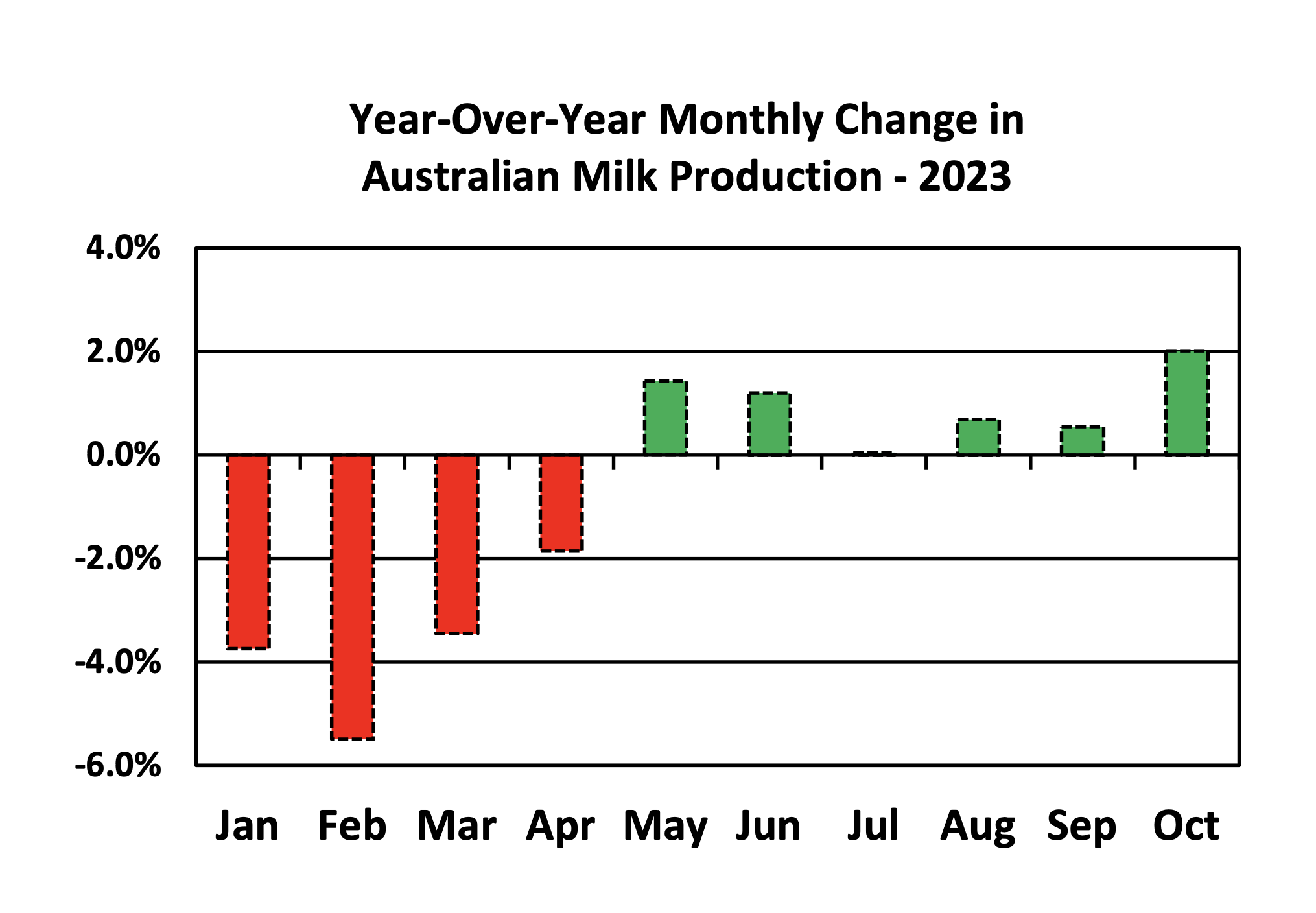

Strong farmgate prices expected to continueIn Australia, milk production is forecast to increase 1% to 8.5 million tons in 2024 as beef cattle prices have fallen and labour shortages abated. Both issues have been major contributing factors in the decline in milk production over the prior 3 years, according to a recent USDA World Markets and Trade report for dairy.

A rebuild in the beef herd after multi-year droughts from 2017-2019 saw significant conversions of dairy farms into beef cattle farms, where operations are less labor intensive, and operating costs are more easily controlled. Over the last 18 months, beef cattle prices have retreated considerably as beef cattle supplies rebounded.

Labour shortages continue to be an issue for Australian dairy farmers, but have also improved as the number of working holidaymakers has returned to pre-pandemic levels and workers entering as part of the Pacific Australia Labor Mobility (PALM) scheme are at record levels. The dual effects of improved labor availability and significantly weaker beef cattle prices have stifled the incentive for dairy farmers to transition to beef cattle farming.

Strong farmgate milk prices are expected to continue in 2024, providing further tailwinds for increased milk production. This surge in prices is fuelled by a growing number of domestic processors vying for a diminishing milk pool.

Australia consumes 65% of its production domestically and higher costs are passed to domestic wholesalers, particularly with short shelf-life products with limited import competition. The relatively high share of milk used domestically which limited exposure to lower international prices, coupled with ability to pass higher costs to domestic wholesalers intensified competition for milk supply, ultimately contributing to farm-gate milk prices this season that surpassed initial projections.

This is evident in the price gap between Australian and New Zealand milk, where the former exports 35% of production, while the latter, heavily influenced by world export prices, exports 90 percent of its milk production.