US beef production challenges: past, present and future

The beef and cattle market has been hit hard with production cost increases, on top of drought conditions that have increased feed costs, writes Timothy Wier for The Cattle Site.Despite these factors, however, cattle prices have remained disproportionately low, forcing many farmers to make some tough decisions around feed, weather and marketing.

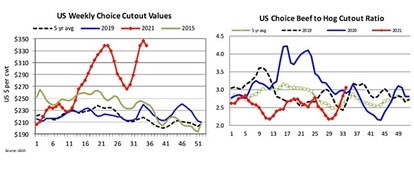

On top of those developments, supply chain issues and meatpacking slowdowns combined with increasing consumer demand for meat products has resulted in very high consumer prices, with cutouts sitting in the $350-360 range.

Because of these intervening variables, cattle prices aren’t responding as a result of high demand, which is frustrating for many producers.

Because of these intervening variables, cattle prices aren’t responding as a result of high demand, which is frustrating for many producers.

Canfax, a market analysis division of the Canadian Cattlemen’s Association, has kept a watchful eye on the North American market. One of their senior analysts, Brian Perillat, recently discussed some of the developments in the US and what we should expect in the near future.

Shifting trends in global meat markets

Currently, the beef price relative to pork has been much cheaper than in recent years, causing that price ratio to increase. Generally, there starts to be market implications once that ratio passes 3.5. However, those changes are likely not due to falling beef prices, which continue to remain strong in the face of global demand, but due to recent events that are impacting the pork market.

Specifically, the impact of African swine fever in China has led to a 2019-2020 decline in meat supplies and consumption, which is a new phenomenon within the past 50 years. China has also seen major supply chain issues over the past few years, but they’re continuing to rebuild after their major ASF outbreak.

The US is also vacillating between being a new exporter of beef versus a net importer over the past decade. Last year, the US imported a net 800 million pounds of beef. This year, however, it looks like the US will export 800 million pounds of beef, which is a 1.6 billion pound switch.

China is also increasing its significance in the global beef economy. Ten years ago, they were a very small beef importer. Now, they account for roughly 30% of all global beef imports, totaling around 6.1 million pounds.

All of these changes are sure to impact consumption patterns. However, the major takeaway is that international demand remains strong, which will help support higher beef prices.

Challenges in U.S. beef production

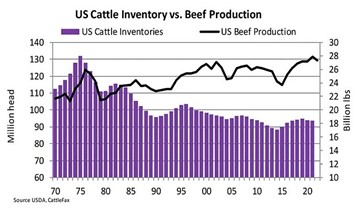

One of the positive implications for the US marketplace is the decline in the cattle population over the past three years, as their breeding herd last peaked in 2019. The US has roughly one million less breeding cows, and 500,000 fewer outside of feedlots. The main reason for this is that heifer numbers are down due to droughts and elevated grain prices.

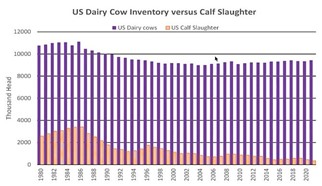

However, consumer beef demand remains high, prompting the industry to figure out how to produce more beef off of less cow. Part of this support comes from the dairy industry, which has faced a shrinking demand for veal, from one million head to under 400,000 head, which is more than a 60% decrease. This has caused more dairy calves to go into feeder programs and feedlots as well as a lot of crossbreeding. Right now, there are 9.5 million dairy cows in the US.

However, consumer beef demand remains high, prompting the industry to figure out how to produce more beef off of less cow. Part of this support comes from the dairy industry, which has faced a shrinking demand for veal, from one million head to under 400,000 head, which is more than a 60% decrease. This has caused more dairy calves to go into feeder programs and feedlots as well as a lot of crossbreeding. Right now, there are 9.5 million dairy cows in the US.

So even in the last few years, dairy cows are up 4%, and calf slaughters are down almost 60%. This means that there are at least 800,000, possibly even a million, more feeder cattle going into the beef supply chain which has elevated beef supplies. This is expected to continue in the future.

So even in the last few years, dairy cows are up 4%, and calf slaughters are down almost 60%. This means that there are at least 800,000, possibly even a million, more feeder cattle going into the beef supply chain which has elevated beef supplies. This is expected to continue in the future.

Interpreting cattle futures

Right now, one of the major challenges comes from price signals, which aren’t making their way down the supply chain to the producer. Some packers, especially US packers, are having trouble with plant breakdowns or labor issues, which cause additional weight on the cattle market. This means the producer isn’t capturing the proportion of the dollar they would like.

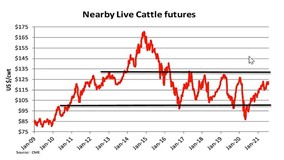

In terms of futures pricing for 2022, cattle prices have stayed strong because of the elevated demand as well as a tightening of the supply. However, it’s still a slow-turning ship, and current prices are having trouble pushing above $125 per cwt (see graph below).

This is why risk management still matters so much, because there could be other mitigating circumstances that keep those prices from reaching those predictions. In fact, we’ve only seen cattle prices in the $140s a couple of times before, so there’s a good chance the reality will be more modest than the futures.

This is why risk management still matters so much, because there could be other mitigating circumstances that keep those prices from reaching those predictions. In fact, we’ve only seen cattle prices in the $140s a couple of times before, so there’s a good chance the reality will be more modest than the futures.

That said, given the increasing global demand for beef and the fact that North America is well-positioned to supply that beef, reaching those predicted prices is certainly a possible outcome.

TheCattleSite News Desk