AHDB publishes latest insights into red meat demand across the EU

Back in July, the EU commission forecast broadly stable meat availability in the EU this year. Some decline in beef (-1%) and sheep meat (-1%) use was expected to be offset by growth for pig meat (+1%).

Here, we look at how these expectations compare to meat sales at retail level seen so far this year. This can give some insight into how demand compares to supply, and so the reason behind price trends. Of course, we are comparing against the peak period of restaurant closure in spring 2020, which led to much demand switching to retail channels for in-home consumption. So, some decline in retail sales would be expected.

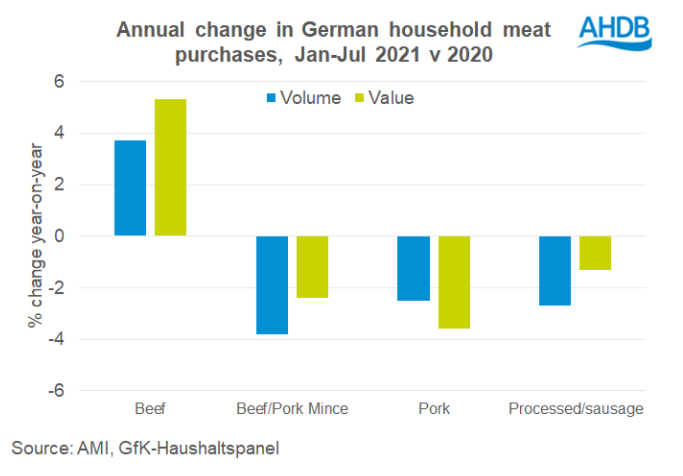

Germany

In the year to July, meat sales have declined by 1.6% year-on-year, according to the latest report from AMI.

Interestingly, however, demand for beef has grown. We can also see that pig meat products have been more affected by declining retail sales.

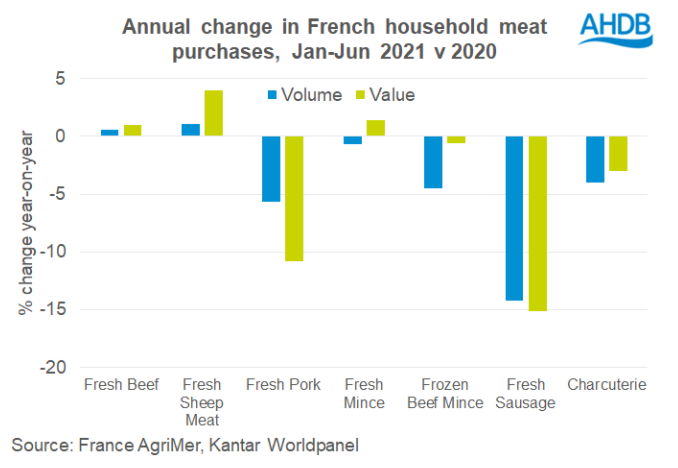

France

Total meat retail sales in the first half of the year were also 4% lower in France. Again, the pig meat products were particularly affected while beef sales recorded some growth. Sheep meat was also able to buck the trend, with volumes sold up by 1% compared to the same period last year.

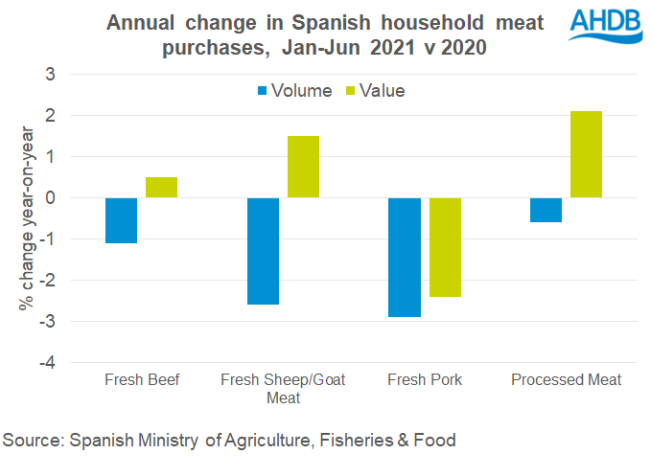

Spain

The trend has been more consistent across meat products in Spain. In the first half of the year, meat trail sales were 2% lower than in 2020. Pork and lamb have seen a slightly larger drop-off than beef.

Summary

So, what key themes can we take from the latest data? While we can’t see how much sales through foodservice may have increased this year, it seems that pig meat has had the most difficulty holding on to gains made at retail level last year. Market reports have also described pig meat demand as subdued. More pig meat is expected to be available in the EU this year, with consumption rising and exports weakening as the year progresses. Against this backdrop, the price falls we have seen on the continent recently are not surprising.

On the other hand, there is also some indication of beef demand being firmer so far. Beef supplies are not set to increase this year, and so the relatively robust demand levels have been able to offer support to EU cattle prices.

Words: Bethan Wilkins