What's behind high global beef prices?

Many countries around the world are currently experiencing high prices for cattle or beef, driven by a combination of local and international factors, namely tighter supplies and high export demand. Let’s look at the situation in more detail.Tighter supplies in Brazil and Australia

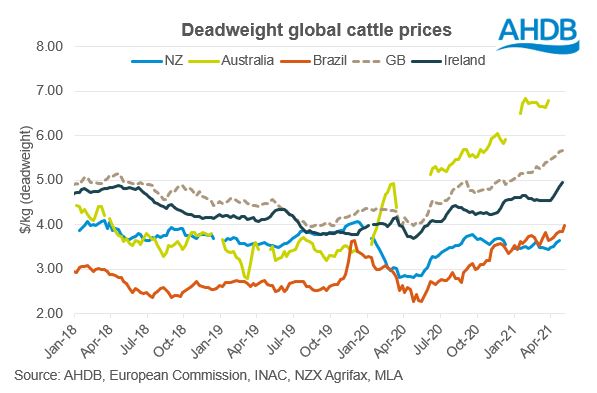

Lower supplies and robust export demand have contributed to notable price inflation in Brazilian cattle prices, with deadweight steer prices in the first week of May over 70% higher year-on-year in US dollar terms.

Brazilian cattle kill is currently below last year’s levels, with total kill for the first quarter of 2021 down 12% year-on-year according to Meat and Livestock Australia. Irregular rainfall in 2020 hampered grass growth and pasture quality, which has subsequently delayed cattle finishing. Robust export demand from China is helping support Brazilian prices; shipments grew by 31% year-on-year during the first quarter of 2021.

Chinese protein demand continues to influence global beef markets. China’s beef prices have been steadily rising for some time, initially driven by ASF, which reduced pork production and led to consumers turning to other proteins. COVID-19 then caused disruption to meat processing, but beef demand remained robust, adding further demand for imports. In 2020, Chinese imports of fresh and frozen beef rose by 28% year-on-year, rising by a further 20% year-on-year during the first quarter of 2021.

Australia is reportedly hosting its smallest cattle inventory for over 30 years, due to drought and subsequent de-stocking. Following more favourable conditions in 2020, many producers are now replenishing their herds, causing increased competition for available supplies and driving up cattle prices. A lower inventory has also contributed to Australian beef exports for Jan-Mar 2021 falling 22% year-on-year.

Europe

Although not a major exported in global terms, supplies in Europe are also tighter than previous years, linked with declining numbers of dairy and suckler cows. This will have supported generally firmer European cattle prices; the EU average R3 steer price was up 12% year-on-year in the third week of May 2021.

Demand drives prices in US and Argentina

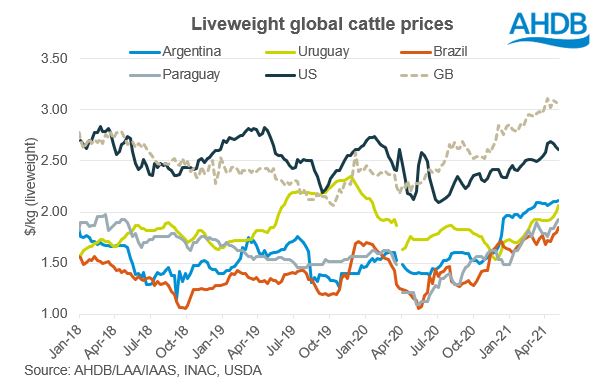

While high Brazilian and Australian prices have been largely supply-driven, the US has seen price strength from the other side. US wholesale beef prices have increased notably over the last few weeks, driven by increased demand from retail, reopening foodservice and export growth (mostly to China). In April, average wholesale beef prices were 5% higher year-on-year, and up 19% when compared to 2019 (pre-Covid).

However, despite some firming in US cattle prices, processing capacity is reportedly limiting growth at the farm gate. Reports suggest that US cattle supplies are plentiful, but processors have been operating at capacity for some time, unable to increase slaughter pace to meet demand.

Argentina has recently imposed a 30-day ban on beef exports to try and tackle rising domestic prices, largely driven by high Asian (Chinese) demand. This could further limit global supplies, with more product potentially drawn into China from elsewhere to compensate. Argentina is China’s second largest supplier of beef behind Brazil.

What could this mean for the UK?

The UK does the majority of its beef trade with the EU (specifically Ireland), with a relatively small proportion of beef traded outside the bloc. UK beef prices are also currently elevated, although influences are perhaps more local in nature; domestic retail/foodservice demand shifts, and export demand and supplies on the continent. Lower supplies and higher prices in the EU could limit UK beef imports. However, high cattle prices in the UK may work against this, with Irish cattle, for example, being more price competitive.

We will be publishing our next UK beef outlook in July. In the meantime, you can read our long-term market outlook for the sector.