US December beef exports are outstanding - USMEF

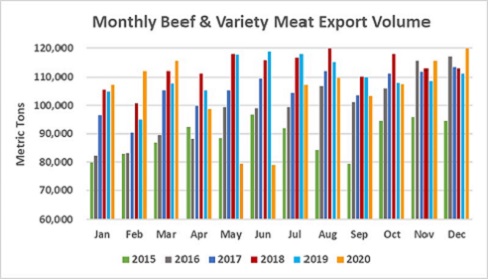

Reporting from the US Meat Exporters Federation shows that US beef exports showed strong momentum, with December 2020 posting one of the best months on record.

Data from the USDA and analysis from the US Meat Export Federation (USMEF) found that US beef exports finished 2020 lower year-over-year, falling 5 percent in both volume (1.25 million metric tonnes MMT) and value ($7.65 billion). But beef exports finished the year with very strong momentum, with fourth quarter volume up 4.5 percent from 2019 and posting one of the best months on record in December.

“Obviously the surge in demand from China, especially in the first half of 2020, was a driving force behind the record performance for US pork exports,” said USMEF President and CEO Dan Halstrom. “But China was not the only success story in 2020, as exports achieved growth in a broad range of markets. Diversifying export markets is a top priority for USMEF and the US industry, and that strategy paid dividends – especially in the fourth quarter, when exports to China/Hong Kong were down 9 percent from 2019 but shipments to the rest of the world nearly offset that slowdown.”

.jpg)

Beef exports were heavily impacted by foodservice restrictions in many major markets but trended higher late in the year, bolstered by very strong retail and holiday demand.

“Consumers across the world responded to the COVID-19 pandemic by seeking high-quality products they could enjoy at home, and US beef and pork definitely met this need,” Halstrom said. “We expect these retail and home-delivery demand trends to continue even as sit-down restaurant dining recovers, creating robust opportunities for US red meat export growth.”

December beef exports totalled 119,892 mt, up 8 percent from December 2019 and the largest in nearly 10 years. Export value was $744 million, up 9 percent from a year ago and the second highest total on record (trailing only July 2018). December exports of beef muscle cuts were the second largest ever at 93,941 mt, climbing 11 percent year-over-year in both volume and value ($659.8 million). For 2020, beef muscle cut exports were down 2 percent year-over-year at 976,953 mt and fell 5 percent in value to $6.77 billion.

Beef export value equated to $349.10 per head of fed slaughter in December, up 9 percent year-over-year and the highest since April. The full-year average was $302.31 per head, down 2 percent from 2019. December exports accounted for 15 percent of total beef production and 12.6 percent for muscle cuts, exceeding the December 2019 ratios of 14.3 percent and 11.6 percent, respectively. 2020 exports accounted for 13.5 percent of total beef production and 11.3 percent for muscle cuts, compared to 14.1 percent and 11.4 percent, respectively, in 2019.

Asian markets shine for beef exports, including new records in Taiwan and China

Demand for US beef exports proved resilient in most Asian markets in 2020, though with substantial shifts from foodservice to retail in some destinations. The limited labour situation challenged exports of certain items, especially variety meats, although December exports of beef variety meats were the largest since March.

Exports to leading market Japan slipped 2 percent year-over-year to 306,140 mt, with value holding steady at $1.94 billion. Beef muscle cut exports to Japan climbed 5 percent to 259,412 mt, with value up 1 percent to $1.57 billion. US beef regained market share in Japan, climbing from 41 percent in 2019 to 44 percent in 2020, benefiting from the duty reductions in the US-Japan Trade Agreement.

Beef exports to South Korea also held up relatively well, though shipments trailed the 2019 record by 4 percent at 246,231 mt, valued at $1.72 billion (down 6.5 percent). US beef made substantial market share gains in Korea in 2020, capturing nearly 53 percent of total imports (up from 51.5 percent in 2019) and 64 percent of chilled imports (up from 62 percent). Korea’s imports of US chilled beef set another new record in 2020, totalling 62,825 mt (up 14.5 percent).

The US-China Phase One Economic and Trade Agreement took effect in March, making beef from a much larger percentage of US cattle eligible for the rapidly growing Chinese market. The US industry capitalised in a big way, with exports quadrupling year-over-year to a record 42,813 mt, valued at $310.2 million (up 260 percent). Since September, the US has surpassed Australia as the largest supplier of grain-beef to China.

Other 2020 highlights for US beef exports include

- Exports to Taiwan set a new volume record for the fifth consecutive year at 63,752 mt, slightly exceeding 2019, though export value slipped 3 percent to $551.7 million. The United States continued to dominate Taiwan’s chilled beef imports in 2020, capturing 76 percent market share.

- While beef exports to Mexico were significantly lower year-over-year, demand has rebounded in recent months. In December, beef muscle cut exports to Mexico reached 16,647 mt, the largest volume since 2009. Total December export volume was 27,230 mt, up 25 percent from a year ago, with value up 23 percent to $127 million. For the full year, exports to Mexico finished 18 percent below 2019 at 192,951 mt, valued at $852.6 million (down 23 percent).

- Following a down year in 2019, beef exports to Canada rebounded to 108,227 mt, up 8 percent year-over-year. Export value increased 11 percent to $727.5 million.

- Africa continued to emerge as a growing destination for beef variety meats, led by strong demand in South Africa, Gabon, Cote d’Ivoire and Ethiopia. Variety meat exports to the region increased 35 percent to 26,450 mt, valued at $20.1 million (up 32 percent).

TheCattleSite News Desk