2018 Beef Exports Record-Large

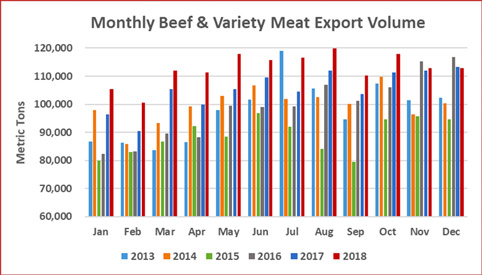

US - Last year US beef exports shattered the previous value record and achieved a new high for volume, according to year-end 2018 statistics released by USDA and compiled by USMEF

Fueled by tremendous demand in South Korea, Japan, Taiwan and the ASEAN region, US beef exports reached 1.35 million metric tons (mt), up 7 percent from 2017 and exceeding the 2011 record by 5 percent. Export value soared to $8.33 billion, breaking the 2017 record by $1.06 billion – an increase of 15 percent. For December only, beef export volume was down slightly from a year ago to 112,777 mt, but value still increased 4 percent to $700.2 million.

Beef export value was also record-shattering on a per-head basis, averaging $323.14 per head of fed slaughter in 2018. This was a 13 percent increase over 2017 and exceeded the 2014 record by 8 percent. Beef exports accounted for 13.5 percent of total beef production in 2018 and 11.1 percent for muscle cuts, up from 12.9 percent and 10.4 percent, respectively, in 2017.

Korea accounts for half of the $1 billion surge in beef exports

While demand for US beef showed remarkable strength throughout the world in 2018, no market exemplified this momentum more than South Korea. Exports to Korea increased 30 percent year-over-year in volume to 239,676 mt and jumped 43 percent in value to $1.75 billion – an increase of $526 million over the 2017 record and more than double the value total posted just three years ago. Chilled beef exports to Korea increased 19 percent to 53,823 mt and climbed 29 percent in value to a record $525 million, illustrating US beef’s surging success in the Korean retail and foodservice sectors. US beef accounted for 58 percent of Korea’s chilled beef imports in 2018.

"There may have been no greater ag trade success story in 2018 than US beef exports to Korea," said Dan Halstrom, USMEF president and CEO. "Less than a decade removed from street protests opposing the reopening of this market, Koreans now consume more US beef per capita than any international destination. This is a testament to the US beef industry’s strong commitment to the Korean market and the outstanding support received from the US government – through both USDA promotional funding and the negotiation of the Korea-US Free Trade Agreement (KORUS), which has dramatically lowered import duties on US beef."

Since KORUS was implemented in 2012, the import duty rate on US beef has declined from 40 to 18.7 percent and will fall to zero by 2026. US beef’s main competitors also have free trade agreements with Korea but currently face higher duty rates than the US, including Australia (24 percent), Canada (26.6 percent) and New Zealand (26.6 percent).

Other 2018 highlights for US beef exports include:

- Exports to leading market Japan increased 7 percent from a year ago in volume (330,217 mt) and 10 percent in value ($2.08 billion, topping $2 billion for the first time in the post-BSE era). The United States is Japan’s largest beef supplier by value and a close second to Australia in volume, but this position is tenuous due to a widening tariff rate gap between US beef and its main competitors, all of which secured tariff rate relief under the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

- Taiwan’s demand for US beef continued to surge in 2018, with exports increasing 33 percent in volume (59,694 mt) and 34 percent in value ($550 million) from the previous records set in 2017. Export value to Taiwan has doubled over the past five years, setting six consecutive records, and US beef holds more than 75 percent of Taiwan’s chilled beef market – the largest share of any Asian destination.

- While total beef exports to Mexico increased only slightly year-over-year in volume to 239,110, beef muscle cuts achieved strong growth – climbing 7 percent to 142,514 mt. Total export value was up 8 percent to $1.06 billion, exceeding $1 billion for the first time since 2015. Muscle cut value increased 11 percent to $828.8 million.

- Beef exports to China/Hong Kong softened in November and December and finished the year 3 percent lower in volume at 130,129 mt. However, export value still climbed 12 percent to $1.03 billion (marking the first time since 2014 that US beef exports topped $1 billion in four separate markets). This included exports to China of 7,297 mt valued at $60.8 million. China reopened to US beef in June 2017 after a 13-year absence, but US beef has been heavily disadvantaged by the 25 percent retaliatory duty imposed by China last year, bringing the total tariff rate on US beef to 37 percent. By comparison, Australian beef pays just 6 percent and New Zealand beef is duty-free, benefiting from free trade agreements with China.

- Led by outstanding growth in the Philippines and Vietnam and larger shipments to Indonesia, beef exports to the ASEAN region increased 20 percent from a year ago in volume (49,226 mt) and 30 percent in value ($274.6 million).

- Strong growth in Colombia kept beef exports to South America steady with the previous year’s volume at 28,333 mt, while value set a new record at $126.2 million (up 10 percent). Exports were also higher year-over-year to Peru but declined to Chile as Brazil and Argentina’s exports to Chile surged, benefiting from weaker currencies.

- A strong performance in mainstay market Guatemala and significant growth in Costa Rica and Panama pushed beef exports to Central America to record highs in volume (14,739 mt, up 14 percent) and value ($80 million, up 11 percent).

TheCattleSite News Desk