Wholesale Meat Prices Generally Lower Since June

US - Seasonal changes in meat demand are well established among analysts but this year certain cuts are preserving margins for some wholesalers, writes John D Anderson of the American Farm Bureau Federation.Wholesale Meat Prices

Wholesale beef prices have been generally lower over the past month. The comprehensive boxed beef cutout value (a weekly average value which aggregates wholesale prices across quality grades and branding programs) peaked at just over $200/cwt in the week prior to Memorial Day.

Since that time, it has declined more-or-less steadily to its current level: $192.22 last week. Wholesale pork prices rose steadily – even sharply at times – until the end of June. The pork cutout has dropped about $7 in value so far this month, working out to $103.16/cwt last week.

Wholesale chicken prices have been on the slide for about as long as beef. After topping out at 203.53 cents/lb just before Memorial Day, boneless/skinless chicken breast prices dropped to 180.75 two weeks ago before rebounding to 182.61 last week.

A big part of the decline in meat prices is related to seasonal factors. Aggressive purchasing by retailers in advance of the Memorial Day holiday likely helped pump up beef prices, and prices declined when that buying pressure subsided.

This year, pork and chicken prices peaked at about the same time they did last year – though for chicken, the peak was at a price point far above last year’s levels in the mid-150s.

It is interesting to dig a little deeper into the seasonality of prices by looking at individual primals within the cutout. Since the late-May peak, among the cutout components the largest decline has been on the loin primal.

Its price has declined by almost 9 per cent . Over the past decade, the loin primal (on the comprehensive cutout) has peaked around week 17 (late-April/early-May) and then declined steadily to about week 40 (early-October).

This year’s peak came about a month later than that average, but the decline so far has been consistent with normal seasonal behavior for the loin. As for the other major primals, rib, chuck, and round prices have declined by 1.5 per cent , 3.2 per cent , and 3.6 per cent , respectively, since the late-May peak.

These trends are broadly consistent with normal seasonal behavior. What has been somewhat counter-seasonal has been the behavior of the brisket, short plate, and flank primals. In contrast to the major middle and end meat primals, these have all increased in value over the past month.

Brisket, short plate, and flank prices have increased by 3.5 per cent , 1.3 per cent , and 7.7 per cent since the week prior to Memorial Day. Were these prices steady-to-declining as would be more normal seasonally, the boxed beef cutout would have dropped even more than it has over the last month and a half.

The Markets

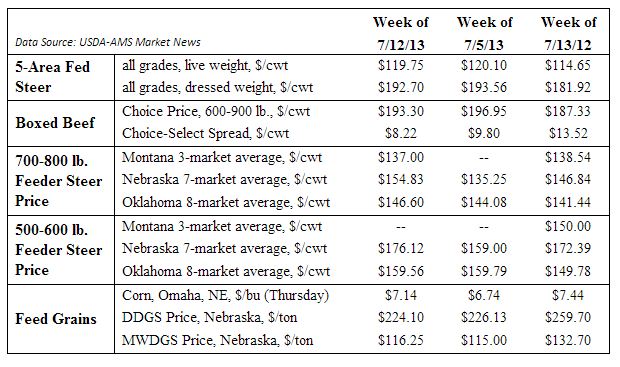

Wholesale beef prices continued to skid lower last week. The choice boxed beef cutout value dropped $3.65 from the prior week, working out to $193.30. This is the lowest value for the choice cutout since the end of April.

Fed cattle prices were somewhat mixed last week. Southern Plains prices were basically steady at $119; Corn Belt prices were 50 cents to $1 lower at around $120. The 5-Area weighted average fed steer price last week was $119.75, down 35 cents from the previous week.

Feeder and stocker cattle prices have been up over the past two weeks – last week and the preceding July 4th holiday week. According to last week’s National Feeder and Stocker Cattle Summary report, heavy feeder cattle have gained $6 to $10 over the past two weeks while stocker prices have been steady to $3 higher.

Cash corn prices were also higher last week. According to USDA Agricultural Marketing Service data, cash corn bids at Kansas City and Omaha were around 35 to 40 cents higher than the prior week. There were no major surprises in last week’s WASDE report, but obviously current supplies remain tight.

TheCattleSite News Desk