Wholesale Beef Prices Set New Records

US - After bouncing around mostly between $185 and $195 per hundredweight (cwt) since the end of summer last year, wholesale beef prices earlier this month finally moved into record territory above the $200 mark, writes John Anderson, Deputy Chief Economist, American Farm Bureau Federation.Last Thursday, the Choice cutout value reached $211.37 before slipping back below $209 on Friday. For the week, the Choice cutout worked out to $210.47, up $2.98 from the prior week. The cutout value has been led higher by strong prices on middle meats.

As of last Friday, the Choice cutout stood at $208.87, up $9.38 from its price at the beginning of the month. Over that period of time, rib and loin primal values increased by $29.52 and $28.36, respectively. By contrast, chuck and round primal values were basically unchanged during that time.

The strength in the boxed beef cutout in May was likely supported to a great extent by retailer purchases in advance of the Memorial Day holiday. The outsized performance of middle meat prices lends credence to this notion. These are the cuts whose highest and best use is on the grill; and Memorial Day is definitely a grilling holiday.

One might hope that this year’s generally poor spring weather (too cool and too wet in many parts of the country) has contributed to a pent-up demand for grilling that was finally satiated this past long weekend. No doubt retailers have already assessed the post-holiday condition of their meat cases. Whether or not they are happy with the holiday movement of beef will have a lot to do with where wholesale prices head from here.

Another factor that will be key to the future direct of wholesale beef prices is the performance of competing meat prices. Those have been very supportive of late. For example, after being flat for just about all of 2012, boneless/skinless chicken breast prices have recently surged, climbing to over 200 cents/pound last week from around 150 cents per pound in mid-April.

This is the highest b/s breast price since about this same time of year in 2004, when prices briefly climbed into the mid-200s. At that time, though, prices on other cuts were such that the 12-city broiler composite never exceeded 85 cents per pound. By contrast, last week’s national broiler composite (successor to the now-discontinued 12-city price series) worked out to 113.53 cents per pound, reflecting dark meat and wing prices that are far above 2004 levels.

Wholesale pork prices have also managed to move up along with the competition. The pork cutout finished the week last week at $94.42 / cwt (FOB plant). As recently at early-April, the pork cutout was struggling to get above $80.

Looking ahead, competing meat prices are likely to become less accommodative of higher beef prices. Last week’s Cold Storage report showed a substantial increase in both poultry and pork stocks. Frozen chicken and pork supplies both increased by 8 per cent over the prior month. For chicken, dark meat stocks increased fairly dramatically, with drumstick and leg quarter stocks up 26 per cent and 19 per cent , respectively.

By contrast, breast and breast meat stocks were actually down 2 per cent month-over-month. For pork, the biggest increase in frozen stocks was also in the lower-valued cuts. Picnic and ham stocks were up 26 per cent and 33 per cent , respectively, compared with the prior month. With trade to China and Russia still disrupted, a larger share of this product will have to find a home on the domestic market – clearly not a positive feature for the wholesale market moving forward.

The Markets

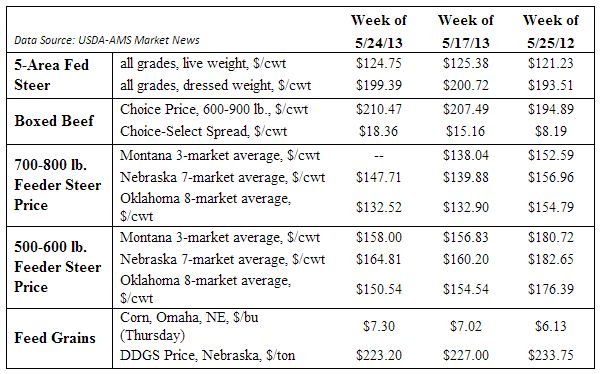

Cash fed cattle prices were down slightly last week, with the 5-Area weighted average steer price coming in at $124.75, down $0.63 from the prior week. This is the third straight week of lower fed cattle prices – not a terribly unusual development, as the market is generally migrating between its spring highs and summer lows at this time of year.

Feeder and stocker prices last week were reported to be somewhat uneven. The National Feeder and Stocker Cattle Summary report from USDA Agricultural Marketing Service called feeder calf prices “unevenly steady to weak” but noted reported prices mostly ranging from $3 higher to $3 lower. Calf prices were called mostly steady to $3 lower, with very light runs of calves in many locations. Corn prices were higher last week.

The Dec ’13 contract added about 15 cents between Tuesday and Friday, with most of that gain coming in Wednesday’s trading. Corn planting, which proceeded at a record pace week before last, was likely slowed down considerably by late-week rains last week.

It is likely that those rains will close the window for corn planting in some locations, with farmers shifting remaining acres to soybeans. It remains to be seen how large that shift will be. At any rate, corn acreage will still be formidable; and last week’s rally probably had has much to do with some surprisingly good offtake figures as it did with lack of planting progress.