LMC: Exchange Rate Influences Trade

UK - According to the latest figures released by DARD’s Policy and Economics Division the gross turnover of the NI Food and Drinks Processing Sector is estimated at £3,994 million for 2011, a 6.7 per cent increase on the £3,744 million recorded in 2010, write market analysts at Meat and Livestock Northern Ireland.The largest increases in gross turnover are estimated to have occurred in the milk and milk products (+£110.7m), beef and sheepmeat (+£62.6m) and poultrymeat (+£43.2m) subsectors. Northern Ireland’s ability to access export markets for our agricultural produce has a key role to play in achieving this level of turnover and thisis strongly influenced by the sterling/euro exchange rate.

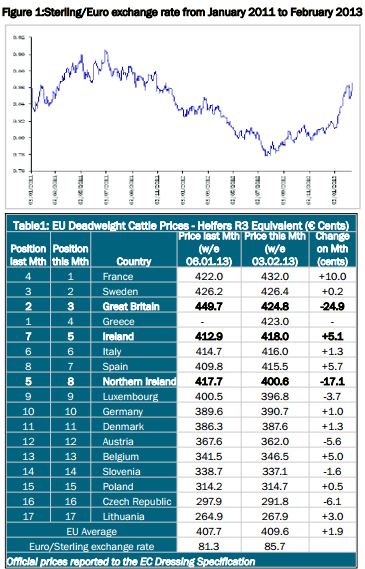

The value of the euro has strengthened significantly against sterling over the last month as indicated in Figure 1 which displays the euro/sterling exchange rate for the last nineteen months. The average

exchange rate last week was €1= £0.86p.

This is an improvement on the lowest recorded exchange rate during the last year of €1=£0.78 in July 2012. The weak sterling has helped put NI, and the UK, in a strong position in terms of agricultural exports within the EU as our produce is now comparatively better value than produce from other countries within the Eurozone.

However while the current exchange rate makes NI and UK export products more competitive it will also lead to imports into the UK becoming less affordable. A weak sterling could therefore be expected to cause an increase in the level of exports but a decline in the volume of some imports.

The increasing competitiveness of UK/NI agricultural products on the export market, combined with increased domestic demand due to reduced competition from cheaper imports, could lead to an improvement in farmgate prices in sterling terms.

This does not necessarily mean an improvement in profitability as given the dependence of agriculture on imports such as oil and fertiliser. A weak sterling will make these inputs more expensive which could further increase the costs of production.

The EU Deadweight Cattle prices league table ranks 17 EU countries in terms of the farmgate price paid for R3 grade heifers (Table 1). It provides a useful example of the influence a weakening in

sterling against euro has on agricultural prices.

Table 1 outlines the prices paid for R3 grade heifers in the week ending 3 February 2013 and the week ending 6 January 2013. The value of the euro against sterling increased from €1=81.3p in the week ending 6 January 2013 to €1=85.7p in the week ending 3 February 2013. During this period the average R3 heifer price in the EU increased by 1.9c/kg to 409.6c/kg in the week ending the 03 February 2013.

If we consider the average R3 heifer price in NI between the two weeks tabulated the average farmgate price has declined by 17.1c/kg in euro terms, moving it down three positions from fifth to eighth. However in sterling terms the average R3 heifer price had actually increased by 3.2p/kg.

Similarly if we consider the average R3 heifer price in GB during the same period it was down 24.9c/kg, moving it from second position to third position on the table. In sterling terms however the average price was down just 2.1p/kg.

These examples should help to highlight how shifts in the euro/sterling exchange rate can strongly influence the competitiveness of NI and UK agricultural produce within and beyond the EU.

From a Northern Ireland perspective a weaker sterling provides NI with a competitive advantage over ROI when selling beef into the UK market. At present ROI is NI’s major competitor in accessing

this valuable market but the current euro/sterling exchange rate is working to the advantage of the NI market.

TheCattleSite News Desk