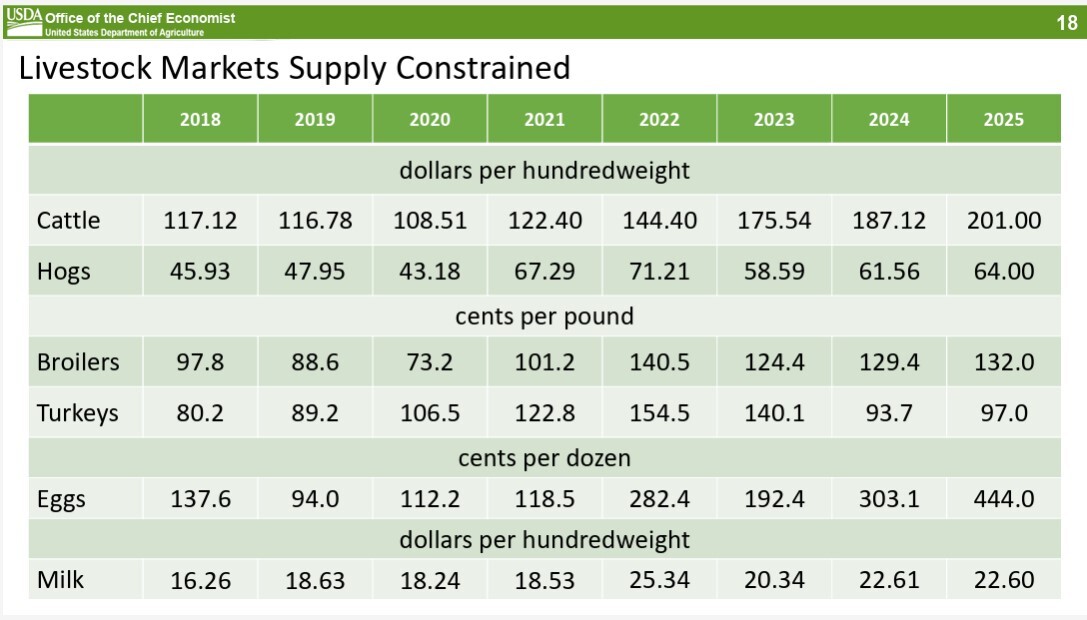

USDA Ag Outlook Forum: Chief economist Seth Meyer’s shares 2025 expectations for beef, swine, egg, dairy

Livestock pricing expectations, including a focus on the layer & egg marketIn his 2025 Agricultural Outlook Forum presentation, USDA Chief Economist Seth Meyer provided insights into the current trends and challenges facing the livestock industry, with a particular focus on the egg market.

Meyer’s analysis highlighted ongoing herd contractions in the cattle sector, productivity shifts in swine production, and the continued struggle of the egg industry to recover from repeated Highly Pathogenic Avian Influenza (HPAI) outbreaks.

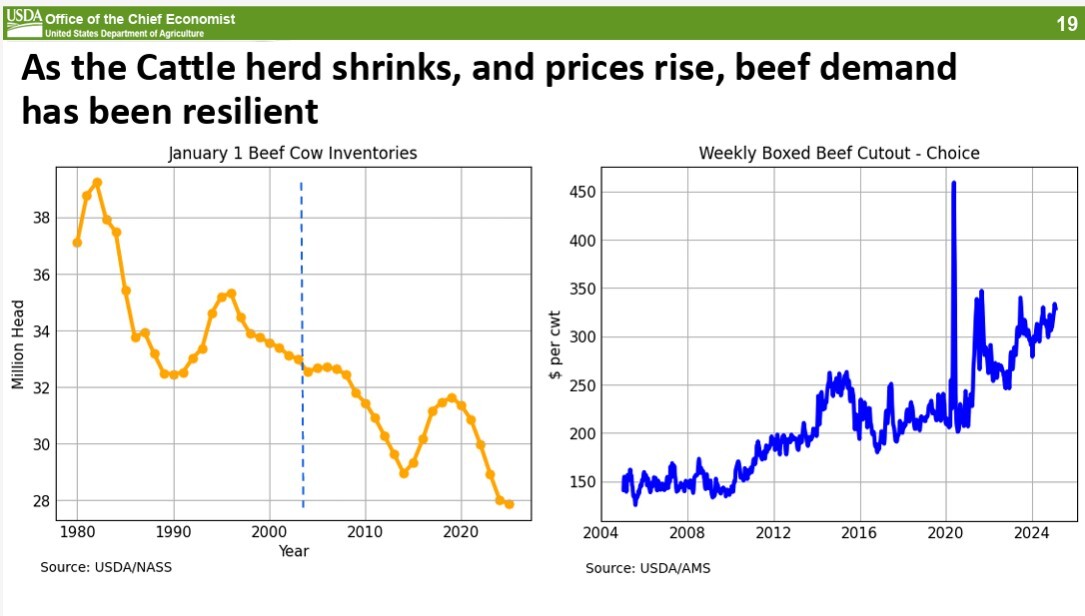

Beef market: Shrinking herd and strong demand

Meyer noted that the cattle herd has been in a contraction phase for several years. Despite record feeder cattle prices, farmers are not yet retaining enough calves to turn the cycle around.

“The cattle herd continues to shrink. My NASS colleagues produced a report in January, thought that maybe when you have record feeder prices that you might start to turn, we're not there yet,” Meyer stated.

The combination of shrinking domestic supplies and robust consumer demand has pushed beef prices higher.

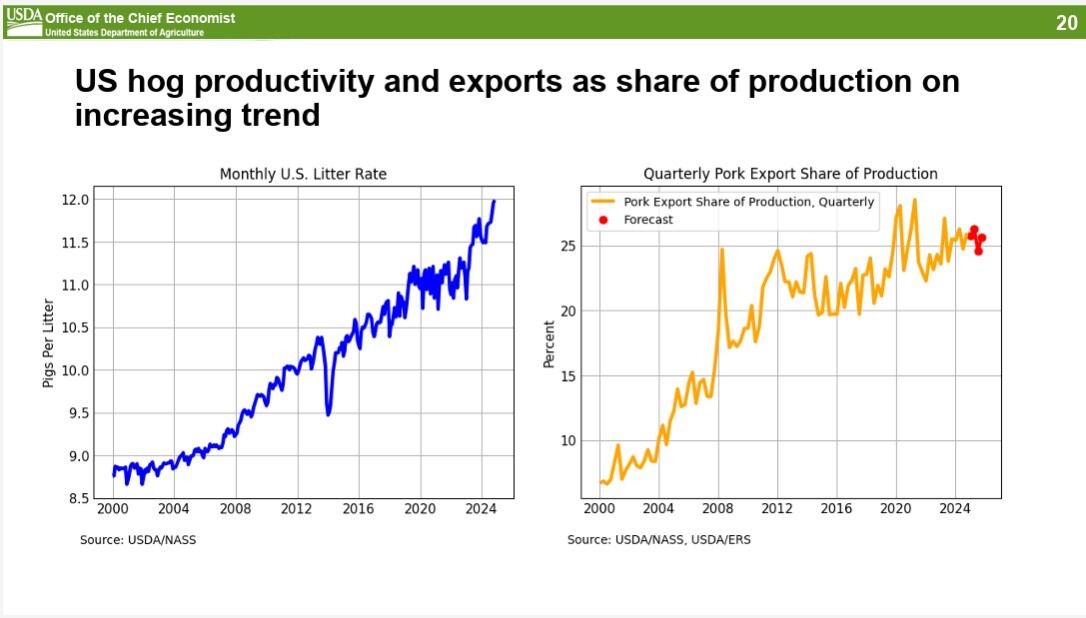

Pig market: Rebounding productivity and export growth

In the swine sector, Meyer pointed to a significant improvement in productivity following a period of slow gains, particularly in pigs per litter.

During and shortly after COVID, Meyer said the US industry saw a fall in pigs per litter.

“The industry has improved its productivity. We have seen that productivity jump, perhaps to trend from before, perhaps faster than trend,” he said. “We'll see how it pans out over time. At the same time, the export share of production has increased.”

Additionally, the industry has benefited from declining feed prices, easing some of the cost pressures on producers.

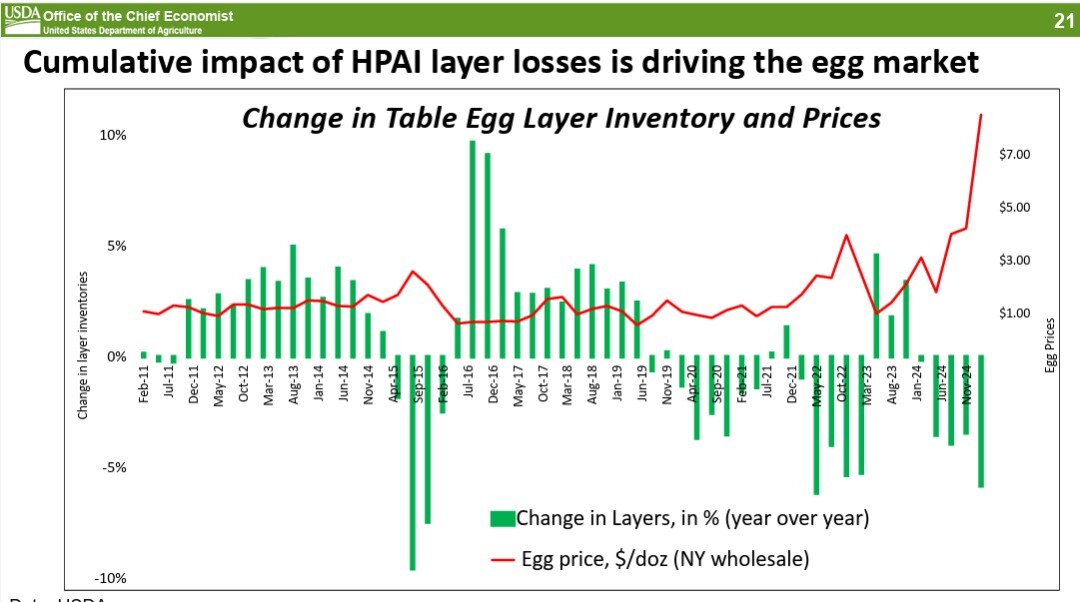

Egg market: The impact of HPAI on supply and prices

The egg industry remains one of the most affected segments of the livestock market, with repeated HPAI outbreaks severely reducing the layer flock population. Meyer emphasized the unique nature of the current crisis compared to past events.

“In 2015, you had the opportunity to rebuild that layer flock in very short order,” he said. “You had the opportunity to put more layers back in, bring supply back up to a level which could alleviate prices.”

However, the ongoing nature of HPAI has prevented similar recovery efforts.

Currently, the U.S. layer flock stands at approximately 291 million birds, well below the preferred 320-325 million.

Meyer underscored the gravity of the situation: “We need an opportunity to get those egg prices down, to have HPAI not repeatedly hit, and to be able to rebuild those layer flocks.”

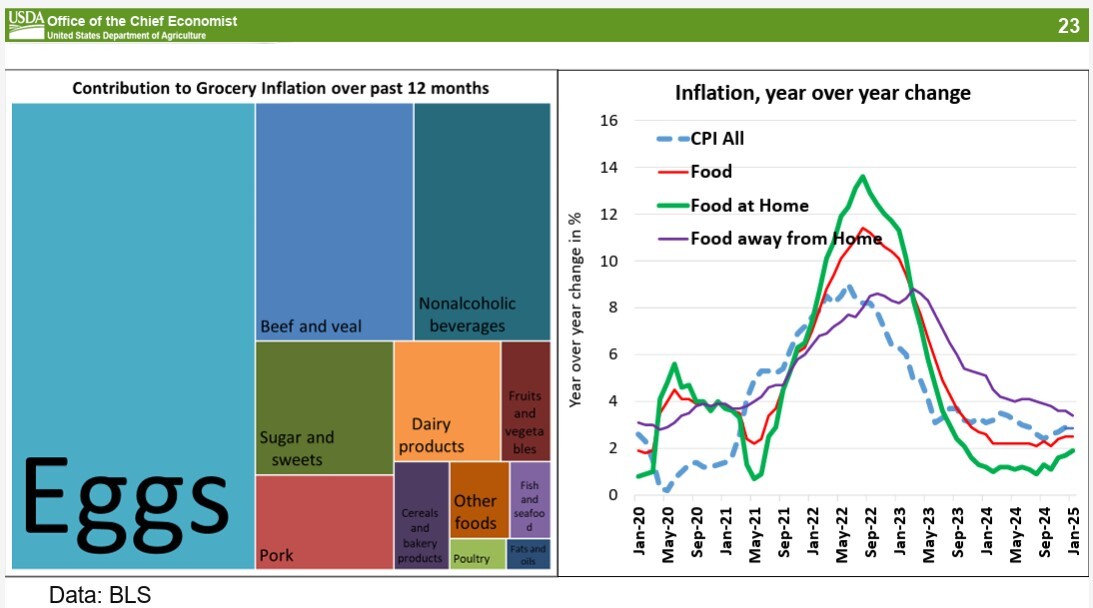

Consumer price implications

Egg markets are particularly inelastic, meaning that consumers have few alternatives when prices rise.

“Consumers, while they may not like the price of eggs, there are not many alternatives to the purchase of eggs,” Meyer pointed out.

This lack of substitutes amplifies the impact of supply disruptions, making price volatility a critical concern.

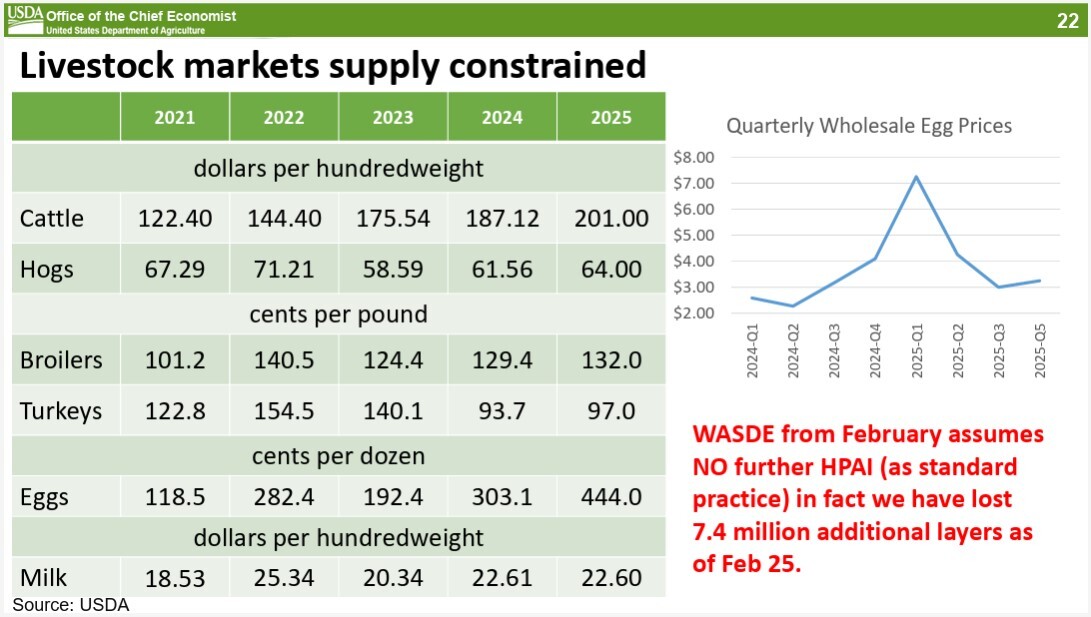

Meyer also highlighted how the recent losses in the layer flock have extended the period of elevated egg prices.

“Just since the February forecast, we have lost another 7.4 million layer birds. We can add on the scale of four to six million back into the flock,” he explained.

However, these numbers indicate that rebuilding efforts are lagging behind losses, meaning price relief may take longer than anticipated.

Moving forward, Meyer acknowledged the difficulty in forecasting the egg market given the unpredictability of HPAI. The USDA’s quarterly egg price estimates assume no future outbreaks.

But Meyer acknowledged the uncertainty in that assumption: “The trick is what should you assume? What number should we assume in depopulations?”

The absence of a clear answer makes long-term projections particularly challenging.

Despite these challenges, Meyer pointed to broader trends in food price inflation, showing that while overall food price increases have moderated, eggs continue to be a major driver of inflation.

“That egg box is basically half,” he noted. “On the dairy side, we've got flat milk prices into the next year. We've seen some of our decline in product prices giving us a little boost into the export market.”

He suggested that the dairy market is getting a little bit more competitive. From a domestic profitability perspective, the feed ratio is staying even with flat prices, so “maybe profitability will improve into the coming year.”

Meyer’s 2025 livestock outlook painted a complex picture for the industry. While some sectors, like swine, are showing signs of recovery, others, such as the cattle, layer and egg markets, continue to struggle with supply constraints and price pressures. The egg market, in particular, faces ongoing disruptions due to HPAI, making price relief difficult to predict. Market dynamics and disease management will be critical factors shaping the this year’s US livestock production.