CoBank: Milk supplies to gradually grow as demand base shifts

Growth in Europe, Oceania and the US continues to be a struggleDespite record-high milk prices earlier in 2022, major exporting countries have expanded their herds only minimally, and CoBank expects this trend to continue well into 2023.

Europe and Oceania (New Zealand and Australia) continue to struggle with sustainability policies, higher feed costs, inclement weather, and an energy crisis in Europe. Likewise, US dairy herd growth has been impaired as farmers continue to battle a number of factors: high costs for feed, construction, replacement heifers, and borrowing, as well as tight labor availability, and the ongoing drought in the West.

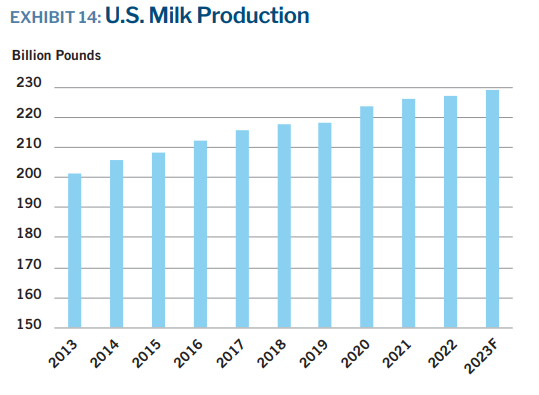

Total milk collections will continue to inch higher, though, as milk production per cow improves. However, Oceania’s milk production growth is stalling during its peak production months and the U.S. stands to potentially gain new export market share in Asia. Dairy product prices will moderate in response to a slow but steady growth in global milk supplies in the face of a sharply slowing global economy.

China, the top dairy-importing country, is heading into its worst COVID outbreak to date and U.S. exports of skim milk powder and whey products may be disproportionately affected. And the high value of the dollar will continue to act as a headwind to U.S. dairy exports. After a year of stronger profits that allowed producers to pay down debt, dairy farm margins will come under more pressure in 2023.

Domestic demand for U.S. dairy products, particularly higher-priced brands, will face headwinds as consumers trade down to trim grocery costs. Processing margins for most dairy categories, though, should remain stable. Milk prices will be lower, but wholesale and retail dairy product prices have remained mostly resilient. Manufacturers of lower-priced products that appeal to cost-sensitive consumers should be well positioned. However, food service demand for cheese may weaken as more consumers dine at home, at the same time that restaurant chains look to trim ingredient costs to appeal to cost-conscious consumers.

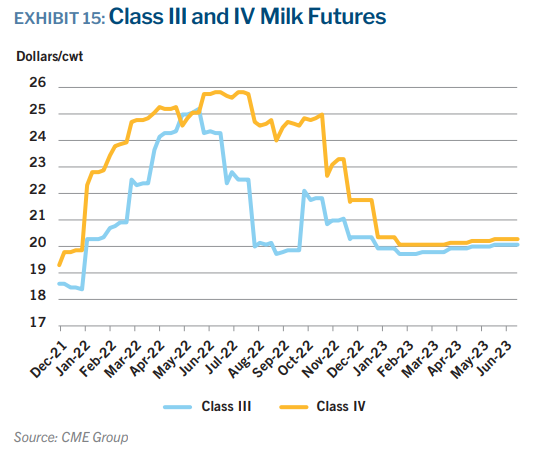

Long-term structural changes to the economy and the dairy sector will persist in 2023. Manufacturers will continue struggling with labor shortages and higher energy costs. And, the continual expansion of cheese processing capacity will siphon milk away from butter churns, guaranteeing ample cheese supplies while keeping butter inventories tight. That scenario suggests that Class IV milk prices will likely maintain a premium to Class III milk in 2023.

This article, written by Tanner Ehmke, is part of a series of 2023 outlook articles from CoBank. Read more by clicking here.