Milk Quotas and Beef Herd: What Will the Effect of Quota Abolition Be?

Many are questioning what role the dairy herd will play in the beef herd going forward as many dairies look to expand after 30 years of quota restriction.According to the latest insight from EBLEX analysts, the prospect of a liberalised milk market has reversed a long term trend of decline in the UK dairy herd.

Initially, some operations switched to suckler beef cows in the 1980s when quotas first came in, but what will happen now quotas have been removed?

Herd Patterns

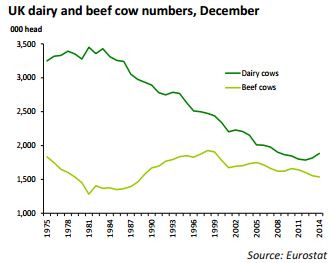

Based on the results of the December DEFRA survey for the UK, dairy cow numbers had been stable in the ten years to 1983, write EBLEX analysts.

They then declined by just over 2 per cent per annum for almost 30 years through to December 2012. Only in the last two years have dairy cow numbers been increasing again, given the firm milk market, at least through to early 2014, and the impending end of the milk quota regime.

The most recent December survey indicated a rise of almost 4 per cent compared with a year earlier and detailed the possibility of a further increase to come, as heifer replacements aged 1-2 years were up almost 2 per cent.

However, since then milk prices have been under more pressure, and some producers may have become less optimistic about future prospects. Others have clearly invested in their dairy operations, including increasing their heifer replacements, and so already committed to expanding their milk operations with the end of quotas.

Lack of Confidence

The AHDB/DairyCo “Farmers intention Survey” was conducted in December 2014 when farmgate milk prices were 20 per cent below the near record levels of a year earlier.

Less than 40 per cent of producers were optimistic about “confidence in their own business” in the next twelve months, compared with nearer two thirds in December 2013.

Covering the next five years, the proportion was somewhat greater at over 50 per cent. Of the one third of producers intending to make future investments in their business, building and equipment dominated (at around 50 per cent or more) with livestock nearer 11 per cent.

In terms of milk production intentions, 33 per cent stated that they would expand milk output in the next two years with 60 per cent maintaining their output.

Dairy Beef - Important Meat Source

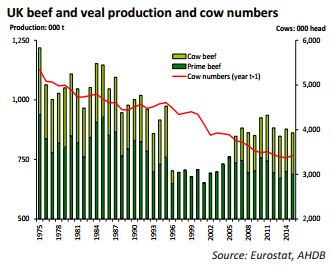

The dairy herd is both an important source of calves for prime beef production and cow beef. By volume, dairy cow beef is more important than that from the beef herd as the turnover of dairy cows is much faster, with most culled after 3-4 lactations.

Following the introduction of milk quotas, beef cow numbers increased steadily before reaching a peak of 1.93 million head in December 1998. This represented an annual growth rate of almost 3 per cent since December 1985.

Over the same period, dairy cow numbers declined by 2 per cent per annum, suggesting there was some switch from dairy cows to beef cows. Since then, the suckler beef industry has been affected by a combination of adverse factors. These include the impact of the BSE crisis of the mid-1990s, the FMD outbreaks of 2001 and 2007 and CAP reforms, which resulted in the end of productionlinked subsidies, such as the suckler cow premium, in 2005.

Long term developments in beef production indicate a decline, given that the total breeding herd has fallen steadily in the last 40 years. This has only been partially offset by rising output per cow as a result of productivity rises, in particular increasing carcase weights.

However, the BSE crisis of March 1996 and subsequent ban on cattle over 30 months entering the human food chain distorted the long term trend. It took until 2005 before prime beef production returned to normal and until 2009 for cow beef to come back into the food chain.