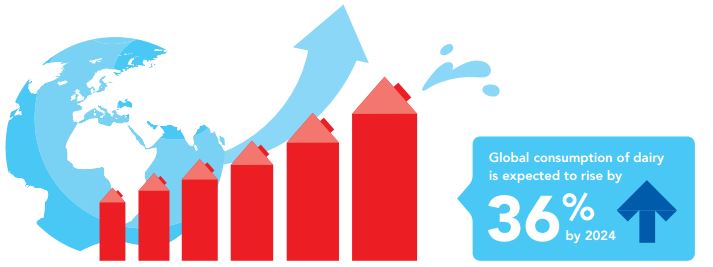

36 Per Cent More Milk By 2024: Why and How?

In ten years the amount of milk we need to produce must increase by over one third, says food packaging and processing multinational Tetrapak.Milk production is on the increase, but it will not match the demand rise, according to Tetrapak's latest Dairy Index.

This means a 'persistent gap' between world demand and supply over over the next decade.

Global consumption of dairy products, including milk, cheese and butter, is expected to reach in excess of 710 million tonnes of liquid milk equivalent by 2024.

Why the Growth?

Booming demand, fuelled mainly by population growth, rising prosperity and urbanisation in Africa, Asia and Latin America, will likely outstrip supply, creating a deficit within the next 10 years that will almost inevitably be met by climbing prices, write analysts at Tetrapak.

*

"Through increased technical knowledge, expertise and commercialisation, markets in the Middle East, such as Saudi Arabia, have already successfully worked to decrease their reliance on milk imports in a drive towards self-sufficiency."

Combined with changing consumption habits and shifting global demographics, our industry is in the throes of transition, with dairy companies increasingly looking beyond their own domestic markets to the wider global landscape, be it to source or to sell.

It is a new, interconnected world, which we believe will present opportunity and challenge in equal measure, says Tetrapak.

As milk producers in established markets look for new ways to respond to a boom in demand in the developing world, they are facing the mirror challenge of falling consumption at home.

In Europe and in North America, for example, changing lifestyles and dietary requirements have caused a significant shift in traditional consumption habits.

Milk sales in the United States are at their lowest level for 30 years, while white milk consumption in western Europe has fallen 0.8 per cent in the last three years.

To maintain a viable business in these markets, and drive value into the sector, dairy producers are shifting towards value-added products that deliver extra nutrition, flavour or other lifestyle benefits, which have greater consumer appeal.

This includes products that meet the rising preference among consumers in developed nations for snacking, ‘deskfasting’ (eating breakfast at work) and ‘on-the-go’ consumption, creating considerable opportunity for innovation, both in terms of the product and the package.

Meanwhile, rapidly rising demand in many less-established markets for milk products towards the more basic end of the spectrum is creating greater incentive for local dairy companies to increase their own production.

To sustain high quality raw milk supply, these companies are reaching out to the export countries to form partnerships.

New Opportunities for Smaller Producing Nations

At the same time, however, with competition for raw milk becoming ever-more fierce, and traditional milk exporting countries reaching production capacity, developing nations are coming under increasing pressure to invest in greater self-sufficiency.

In doing so, of course, they will need to address challenges related to the environment, natural resources and the availability of expertise.

Several markets have already begun that journey. For example, despite its hot and arid climate, more than half of Saudi Arabia’s domestic milk consumption is now met from local supply, and it has built a strong export business to countries across the Middle East.

In parallel, more and more companies in emerging geographies are looking for ways to “stretch” milk, combining it with other ingredients such as juice, cereals, nuts or other ingredients to create new products and formulations.

Taken as a whole, the outlook for the global dairy industry remains extremely strong, particularly for companies that are able to tailor their operations to serve both the booming demand in developing markets, and address the need for exciting new products among consumers in mature geographies.