Has Europe's Beef Herd Grown?

The European Commission (EC) expects beef meat exports to remain at the current low level until 2016.In its short term winter outlook, the EC said that preliminary data of the December 2013 inventory confirmed the results of May-June survey indicating a slight increase in total livestock numbers (+0.4 per cent on the stable level of 2012).

It estimated dairy cow numbers at 0.8 per cent higher while the beef cow herd might decline by 0.9 per cent.

Among the countries with positive developments, German total herd increased by 1.4 per cent , Poland 1.4 per cent, Italy 2.6 per cent and Ireland 0.9 per cent . On the negative side, France, the largest bovine holder in the EU, experienced a drop (-0.8 per cent) for the fifth consecutive year and Spanish herd retreated by 2.1 per cent despite the increase in dairy cow numbers in these two countries.

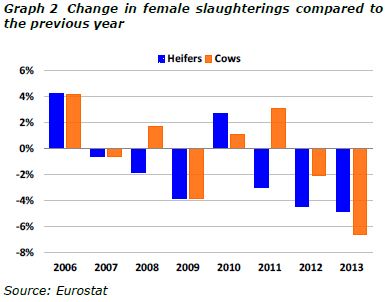

Because of the re-capitalisation of the dairy herd and decreasing trend in specialised beef herd, total bovine slaughterings in 2013 fell sharply by 4 per cent for the second year in a row driven by the strong decline in cow (-6.6 per cent ) and heifers (-4.9 per cent ) slaughterings as illustrated in Graph 2. The high milk prices triggered this continuous rise in heifer retention and the decline in cow culling during the past years.

In addition, in some Member States the preparation for the milk quota abolition scheduled in the spring 2015 might also have contributed to this retention.

In Europe, more than two third of the bovine meat is supplied by the dairy herd. Therefore the current building up of the breeding dairy herd will imply as well more meat to slaughter in the future and the net production is expected to improve modestly in 2014 and more significantly in 2015.

In a context of low supply, 2013 marked a strong reduction in beef meat exports (-23 per cent ) due to the drastic drop in volumes exported to Turkey (-95 per cent ) on grounds of restrictions on sanitary certification and to Russia (-30 per cent ), investing in its domestic production capacity as well as looking for cheaper origins.

In the next two years, beef meat exports are expected to stabilise around this quite low level. Regarding imports, thanks to a recovery of its production, Brazil supplied the largest share of EU 2013 imports which are estimated overall to be about 10 per cent higher than in 2012.

Against the background of a better EU economic situation and after 3 years of contraction, EU domestic consumption is expected to recover slightly driving higher imports in 2014. In 2015, imports are expected to stabilise at 2014 level while consumption might increase by up to 2 per cent . Nevertheless, per capita consumption is expected to remain rather low at 10.7 kg (in retail weight) in 2015 which is the 2012 level.

As for prices, after reaching an historical high of 396 EUR/100 kg in January 2013, they started declining slowly till June when they went below 2012 level and then remained stable. On average, 2013 prices were slightly lower than 2012 (-0.6 per cent).

Michael Priestley