How Much Will Change in Dairying Under the Farm Bill?

Jeremy Daubert, Extension Agent for Rockingham County, answers some questions on what the Farm Bill will mean for the dairy industry.The 2014 Farm Bill has finally been passed by the house and the senate, and signed by President Obama.

The $965 Billion bill has an overall decrease in spending of about 1.7 per cent, writes Mr Daubert.

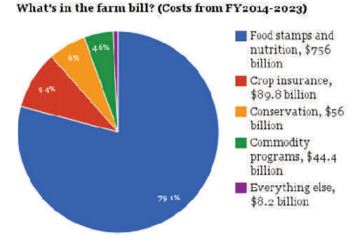

As you can see from the chart, the majority of the “farm” bill, nearly 80 per cent , is food stamps and supplemental nutrition. The remainder is earmarked for various agricultural programs.

This article will focus on the dairy title portion of the bill, Mr Daubert writes. The dairy checkoff program is renewed. The current Milk Income Loss Contract (MILC) program will run until August 30th, if needed. At that point the new program and the rarely used Dairy Export Incentive Program will both be eliminated.

The other program being eliminated is the Dairy Product Price Support program. This is a good thing for dairy producers as this program was outdated and often thought to actually prolong periods of low milk prices since it purchased dairy products and stored them for later resale.

The bill establishes a new program, the Dairy Product Donation Program (DPDP), which will purchase retail dairy products for 3 months or until margins rebound. The DPDP would only activate if margins fall below $4.00 for two consecutive months.

The program would trigger out if US prices exceed international prices by more than 5 per cent . Under this provision USDA would purchase a variety of dairy products to distribute to food banks or other non-profit organizations. USDA is required to distribute, not store, these products.

Organizations receiving USDA purchased dairy products would be prohibited from selling the products back into commercial markets. The other big change to the new dairy policy is the expansion of dairy margin insurance program.

All dairy operations will be eligible to participate in the program. In the first year of the Margin Protection Program (MPP), coverage will be limited to the volume of milk equivalent to the producer’s production history. Production history is defined as the highest level of annual milk production during 2011, 2012 or 2013.

There are also provisions for new producers to enroll in the program. In subsequent years, annual adjustments to the producer’s production history will be made based on the national average growth in overall US milk production as estimated by USDA. Any growth beyond the national average increase will not be protected by the program.

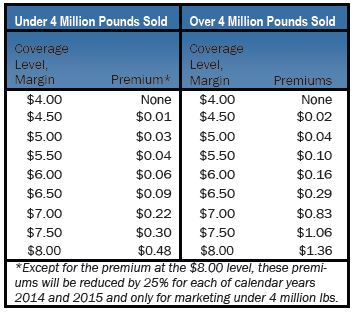

There will be a $100 per year administrative fee to participate in the MPP. In 5 per cent increments, producers will be able to protect from 25 per cent up to 90 per cent of their production history. Producers can select margin protection coverage at $0.50 increments from $4/cwt. through $8/cwt.

Premiums will be fixed for 5 years (through 2018) and are as follows: Dairy operations may participate in either the MPP or the Dairy Livestock Gross Margin Program under the Federal Crop Insurance Act, but not both. The actual margin will be calculated by USDA monthly using a formula with the current average all-milk price minus the average calculated feed cost to produce 100 pounds of milk.

While this farm bill is not perfect, and many of the programs will be implemented over the next 7 months, it is the biggest change to dairy policy in over half a century. We will see how well it will work over the next 5 years. Of course, if milk prices remain high then most of this policy will have little effect on producers.

March 2014