Market Access Triggers Swings in Beef Variety Meat Values

As American beef reaches further across the globe, demand for tongue in Japan, liver in Egypt or heart in Peru is helping the offal industry with virtually 100 per cent of the US herd being sent out in beef exports.This is according to the US Meat Export Federation which says that without demand for intestines in foreign countries there would be little demand domestically and prices would 'tank'.

When does 12 percent equal 28 percent…or nearly 100 percent?

By any name, variety meat is gold to the U.S. beef industry. Total U.S. beef exports in 2012 set a new record at $5.51 billion, write analysts at the USMEF. Beef offal represented 12.8 percent ($703.1 million) of that. It also accounted for 28.4 percent of the total volume of beef exports (321,772 metric tons or 709.4 million pounds). And virtually 100 percent of the U.S. livestock herd is represented in variety meat exports – some part of every animal is sold to international customers.

Courtesy of USMEF

“Demand for both large and small intestines would tank without the international market,” said Jerry Wiggs, export salesman for Greater Omaha Packing Company Inc. “We are selling large intestines to South Korea or Koreans who recently moved to the U.S. And just recently we resumed selling small intestines to Mexico (where they had been banned since BSE was found in the U.S. in late 2003). Without those countries, the markets for those products would basically disappear.”

*

"These consumers may be seeking protein, but they can’t always pay the price of high-end cuts"

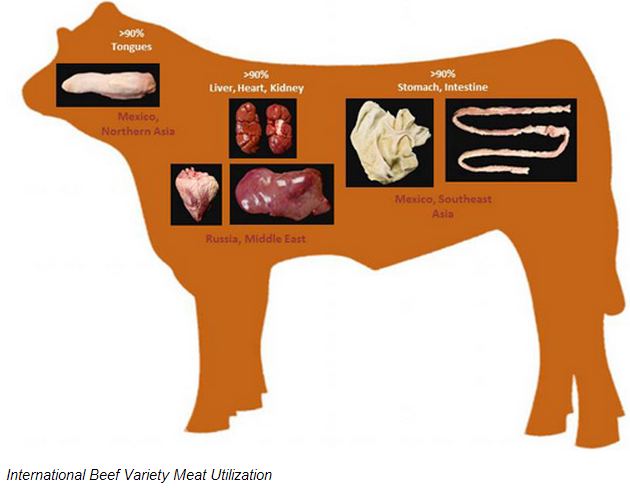

The same can be said for many beef variety meat items. More than 90 percent of U.S.-produced beef tongues are exported, primarily to customers in Northern Asia and Mexico. Buyers in the Middle East, South America and Russia (when the Russian market is open) buy more than 9 out of 10 U.S. beef livers, hearts and kidneys. And consumers in Mexico and Southeast Asia consume more than 75 percent of U.S. beef stomachs.

Not only are international destinations important for consumption of beef items that aren’t eaten in the U.S., but variety meat often is the first U.S. beef tasted by consumers in many countries.

“There are many examples of how variety meat items are the first point of entry for U.S. beef into developing markets,” said Mark Gustafson, vice president of international sales at JBS. “These consumers may be seeking protein, but they can’t always pay the price of high-end cuts. Variety meat items are very economically priced protein. For example, we’re seeing growing interest in beef kidneys to the Ivory Coast and hearts to Peru, which could open a door to other exports down the road.”

Gustafson also noted that even top beef export markets started out primarily as variety meat markets.

“Japan and South Korea are prime examples,” said Gustafson. “When there was a beef import quota in Japan, they didn’t have a quota on variety meat, such as outside skirts and hanging tenders. Japan’s yakiniku industry grew up around variety meat items that were outside the quota with lower duties. The same with Egypt – it once was strictly a liver market, but now buyers there are purchasing muscle cuts.”

Gustafson noted that the U.S. beef industry has not always produced variety meat items such as beef finger meat and chuck flap. At one time, they went directly into trimming.

“Now, it’s not unusual to have an executive from a visiting Asian meat company stand in a processing plant at the trim belt to see what’s going into rendering or trimmings and ask for samples,” he said. “They know what a strip or tenderloin is, but they’re looking for an item to use in soup or as a protein supplement.”

The importance of market access

The premium prices that offals can generate internationally are only meaningful when the United States has unfettered market access. That message has been illustrated vividly twice this year – once as market access was lost and another when access was regained.

Beef livers are one example. There are essentially two prime international markets for U.S. beef livers: Russia and Egypt. The bottom fell out of liver prices when Russia stepped up enforcement of its zero-tolerance policy for residues of the livestock feed additive ractopamine, effectively closing the market.

This action led to liver prices dropping from about 64 cents per pound to 39 cents – a loss of about $3.50 per head just from that one cut. When shipping access to Egypt was threatened by unrest in the Middle East, the price was poised to plummet to 7 cents.

“Russia was a huge niche market,” said Wiggs. “The closing of Russia made Egypt the only game in town (for livers), and they knew it. If Egypt stopped taking livers, they would go into rendering or pet food.”

Russia has a similar effect on beef cheek meat, according to Veronica Leon, vice president of sales for Northern Beef Industries.

“When Russia buys, prices rises about 15 to 20 percent,” she said. “Russian buyers will come in and clean out our inventory.” With about 4.25 pounds of cheek meat per animal going for roughly $1.37 per pound, that Russian presence in the market can add another $1 or so in value per head for this one item alone.

While the disappearance of Russia from the market has depressed prices, the opposite occurred when Japan expanded access in February to include beef from U.S. cattle up to 30 months of age. Demand surged for U.S. beef tongues. For an item that averages 2.8 pounds per animal, the jump from $2 per pound to $4 boosted the value per head from this single cut by about $5.60.

While the tongue and liver are dramatic examples, there are others. Mexico is a key market for U.S. variety meat. Wiggs noted that Mexico’s recent decision to accept sweetbreads has boosted returns, while that country is the primary destination for beef feet.

Leon noted that Mexico also is critical for profitability on beef tripe and lips.

“If Mexico closed, a big percentage of beef tripe likely would go to rendering,” she said. “We’d probably lose $4 to $4.50 per animal. And beef lips are a huge item for Mexico. I have no record of lips going anywhere else. There’s almost 3 pounds per head, and they’re being sold high: $1.75 to $1.85 per pound delivered FOB to Mexico. Demand is great for them in Mexico, but in the U.S. they would have no value at all, and would probably end up in pet food.”

Growth potential

USMEF has had a long and active history of promoting variety meat in the international marketplace, and while their exports have increased in recent years, exporters believe that there is room for continued growth.

In addition to exploring new markets, such as Africa, Gustafson believes there’s growth potential in some existing markets.

“Prior to the finding of BSE in the U.S. in 2003, South Korea – along with Mexico – bought almost 100 percent of the small intestines,” he said. “But we’re really not back into that market yet. As each market opens or expands, it creates more opportunity to move the value base up.

“When I first started in this business, variety meat was an afterthought,” he said. “The quality was generally poor. Most would be sold for pet food. Today, the packaging and quality (of variety meat) has almost become a science in itself. We look at the international markets as premium markets, in large part because of variety meat.”

“The reality is that one or more parts of every beef animal produced in this country is being enjoyed by consumers around the world,” said Dan Halstrom, senior vice president of Marketing and Communications for the U.S. Meat Export Federation (USMEF), which is working actively in more than 100 global markets to raise the visibility of U.S. red meat products, including beef variety meat.

“USMEF is targeting specific countries – and niches within those countries – to demonstrate to meat buyers, food service and retail operators how different muscle cuts or variety meat items can be an ideal solution for their business. It’s an education process, but we’re seeing growth and expect it to continue.”