The Bangladesh Dairy Market: Times of Change

Between 2001 and 2011 Bangladeshi milk consumption doubled, but exports had to rise to bridge the gap between domestic production and the amount of milk being drunk, which started out from a meager 44 millilitres per day.Market Overview

Bangladesh dairy consumption is growing, albeit from relatively low per capita levels (an estimated 44 milliliters of milk per day). When measured against the World Health Organization recommended minimum level of 250 milliliters a day, Bangladesh dairy consumption should increase five-fold. While local milk production has increased, from 1.78 million metric tons in 2001/02 to 3.46 million metric tons in 2011/12, domestic supplies are still lagging, and as a result Bangladesh is importing more dairy products.

| Table 1. Bangladesh: Milk Production in Thousand Metric Tons | ||||||||

| July-June Fiscal Years | 2004/05 | 2005/06 | 2006/07 | 2007/8 | 2008/9 | 2009/10 | 2010/11 | 2011/12 |

| Quantity | 2,140 | 2,270 | 2,280 | 2,650 | 2,286 | 2,365 | 2,947 | 3,463 |

In rural Bangladesh, almost two out of every three households rear cattle to produce milk for personal consumption. Surplus milk can be sold directly to neighbors or in the local market. The average dairy farm has 3.5 head of cattle, with very low average yields of 200-250 liters per 305-day lactation. Low herd yields generally reflect poor management practices and inadequate investment in genetics and veterinary services. In Bangladesh, dairy farming is generally considered to be a subsidiary profession, as male farmers are often more inclined toward field crop agriculture. Traditionally, the Bangladesh dairy sector has been dominated by the Doodhwala and Ghosh communities consisting of small-scale intermediaries who collect fresh milk for processing into ghee, curds, sweets and other products. In the absence of refrigeration, fresh fluid milk typically represents a very small portion of the market.

Fresh milk processing and marketing in Bangladesh began in 1952, with the establishment of Eastern Milk Products Limited, a private company, which sold products under the trade name of Milk Vita. In1965, the company’s ownership was transferred to the Eastern Milk Producers' Cooperative Union Ltd.,the first milk cooperative in what was then East Pakistan. After independence, the cooperative was renamed the Bangladesh Milk Producers Cooperative Union Limited (BMPCUL), and is best known today by its popular brand name, Milk Vita. Milk Vita is Bangladesh's largest dairy, and currently represents almost half of country’s total processed milk production. Members of the Milk Vita marketing cooperative deliver milk to collection points, where it is then transported to a chilling plant before processing. Milk Vita members receive technical training, livestock genetics, veterinary and extension services, and various other production inputs.

In 1998, BRAC, the Bangladesh based development organization, launched BRAC Dairy to assist its village organizations in dairy production and market development. BRAC offers microfinance loans for livestock and provides a range of market services, including transportation, pasteurization, processing, branding and distribution. Independent dealers typically purchase milk directly from approximately 40,000 farmers and transport it to one of BRAC Dairy’s 100 chilling stations, which are mostly located in the western divisions Khulna, Dhaka, Rajshahi, and Rangpur. As BRAC generally offers competitively higher prices, farmers consistently receive a fair market price. BRAC processes milk at a central facility in Gazipur, which produces a range of products under the Aarong brand name. BRAC(Aarong) products include fresh and powdered milk, flavored milk, flavored yoghurt and sour curd. BRAC is the second largest dairy operation in Bangladesh, representing about 20 percent of the countries processed milk output.

In 2002, the Program for Rural Advancement Nationally (PRAN), one of the largest agro-processingfirms in Bangladesh, partnered with Land O Lakes, Tetra Pak, and the U.S. Department of Agriculture(USDA), to introduce ultra high temperature (UHT) treated milk into the Bangladesh School Nutrition Program. The technical expertise developed during this project was also shared with other companies to expand local commercial production of UHT milk. Today, PRAN is the third largest dairy operation in Bangladesh, representing about 10 percent of the market.

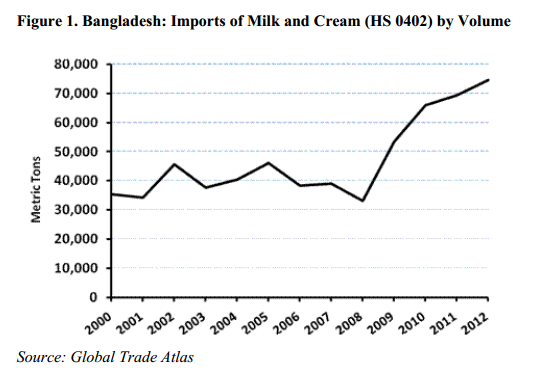

With growing domestic demand for dairy products, a number of companies are importing nonfat drymilk (NFDM) powder. In 2011/12, Bangladesh imports of dairy and cream (HS code 0402) reached arecord $221 million. While NFDM imports will likely continue to increase, local pressures to protectdomestic production could have an effect on trade policy. In April 2009, hundreds of Bangladeshi dairy farmers poured milk on highways to protest imports of cheaper NFDM from India.

| Table 3. Bangladesh: Milk and Cream Imports by Value, Million U.S. Dollars | ||||||||

| July/June Fiscal Years | 2004/05 | 2005/06 | 2006/07 | 2007/8 | 2008/9 | 2009/10 | 2010/11 | 2011/12 |

| Value | 86 | 73 | 83 | 137 | 96 | 106 | 161 | 221 |

Imports of milk and dairy products in Bangladesh are regulated by the Bangladesh Import Policy Order 2009-2012, which sets several requirements, including: (1) A certificate attesting that the product is below the acceptable level of radioactivity (for milk, milk powder and milk products it is 95 bq of CS-137 per kilogram), (2) A certificate indicating that the product is fit for human consumption, and (3) A certificate indicating that the product is free of melamine (the acceptable limit is 1 mg per kilogram). While there are no quantitative restrictions on imports of dairy products, several border charges like supplementary duties, regulatory duties, and value added tax (VAT) are added to the 25-percent (highest level) customs duty for import of these products.