Iowa Farm Outlook: Riding A Bullish Cattle Market

There is always something moving in the cattle markets, ups, downs and sometimes sideways. So where are prices headed, and what can be expected in the future, asks Iowa State University, Shane Ellis. The average Iowa fed cattle price in the second half of October was over $120/cwt, which is more than 20 per cent higher than a year ago. From a historic perspective, that is a fantastic price nearly equal to the record high prices set at the market peak in early April of this year. Looking at the futures market prices for fed cattle, a steady bullish increase in cattle prices is expected by the market place over the next year which would be a deviation away from the normal seasonal declines. There are several factors that individually would influence the market, but when combined, build upon each other to create this market strength.

First, beef production during the coming year is expected to decline four to five per cent. This decline is primarily a cattle numbers issue amplified by the reduction in productive capacity in the drought stricken Southern Plains. Second, fantastic foreign demand has taken export volumes to record highs. In the first three quarters of this year, beef exports were 27 per cent higher than in 2010 and nearly 50 per cent larger than the same period in 2009.

This growth in exports was not anticipated at the beginning of the year and has added to overall demand and made the US a net exporter of beef. Finally, domestic demand has been steady despite the higher price of beef at the retail counter and recent stagnation in the restaurant sector.

Those participating in the futures market are anticipating tighter supplies in the face of tremendous demand for the next year. This is a very reasonable fear for not just this year but also the two to three years after that. All those expectations of future supply and demand are already being taken into account and steam has built up in the market. Now all producers in the cash market have to do is sit and wait for those fantastic prices to come sailing into the cash price port, right? Nothing could happen between now and then, those futures prices will turn into cash prices, right? What could happen? Perhaps asking those questions is like preaching to choir.

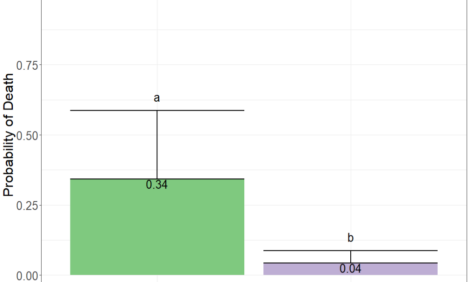

While supply can be anticipated with some certainty, demand is much more liquid and we don’t have to look too far into history to see what can happen. The inserted graph of Iowa fed cattle prices over the past four years indicates the sensitivity of the cattle market to economic conditions. In 2008, cattle prices took a dramatic decline that took a couple years to shake off. Prices took an initial $10/cwt or 12 per cent slide during the financial crisis that marked the start of the recession that would suppress cattle prices for the next year and a half.

Futures prices for the April 09 Live Cattle contract peaked on 1 August, 2008 at $125.25/cwt, then fell to a low of $83.38/cwt by that December. The markets did recover a little and cash market price reached an April 2009 high of just less than $90/cwt. There was out little history lesson. If the goal is to price protect the best price possible for cattle that will be sold in the future, place your price protection when cash prices are peaking or at least on an increase.

Why should cattle producers be concerned? The cattle and beef markets are linked to the economy by the sensitivity of consumers and their perceived economic condition. Even those who did not face extreme challenges from the recession in 2008-09 changed their spending habits because of the general economic uncertainty. Now once again there is a storm of economic crisis brewing for many nations around the globe.

That storm has already started to rain on several European nations, and while their neighbors try to hand them an umbrella, that will not stop the hail when it comes. In turn, the US economy, which is still laboring under its own burdens, will be negatively impacted. More and more analysts are predicting a financial crisis and second dip to the recession are coming. The unknown is when it will happen. Maybe as early as next summer, maybe a year from now, or could there still be the slim chance that the storm will blow itself out. In the face of so much uncertainty, risk management is now paramount.

For cattle producers, protecting the value of your cattle may be as important in 2012 as price protecting your feed was in 2011. If cattle prices predicted on the futures market were apples, the crop hanging on the tree would be the biggest, reddest and sweetest ever seen. There is the chance they could get even bigger by usual time of harvest. Should they be picked now, or wait until the “usual” harvest time and risk having a storm blow them off the tree?

Cattle on Feed Update

Cattle on feed numbers continue to run above the recent average and last year’s inventories. However, placements appear to be getting back on track. Early placements of calves out of the southern plains started the seasonal inventory increase about two months early. As seen in the graphs below the placements of light weight feeders (<700 lbs.) has been above the five year average since June.

Placements of feeder cattle over 700 lbs. has been near a normal trend but in August and September were well below the placements of last year. Cattle that would have gone to stocker pastures during the summer to gain a couple hundred pounds were sent to feedlots early. By year's end feedlot inventory will be back to levels similar to those of last year.

November 2011