EU Livestock and Products Semi-Annual Report 2008

This article provides the cattle industry data from the USDA FAS Livestock and Products Semi-Annual 2008 report for the European Union. A link to the full report is also provided. The full report includes all the tabular data, which we have omitted from this article.Report Highlights:

Elevated beef and milk prices slowed down the contraction of the European Union (EU) cattle herd. The elevated beef prices are partly a result of restricted beef imports. During 2008, EU beef imports are even expected to decline further as the European Commission (EC) strengthened the import requirements for Brazilian beef. The limited supply of beef on the EU market is forecast to revive cattle farming in the New Member States (NMS). Increased supply of pork and rising feed costs induced a “return of the pig cycle”. Despite government support, the EU pork sector lost market share in its two most important markets, Russia and Japan. Due to these dim market conditions, EU pig and pork production is anticipated to fall during 2008. The most significant cuts are anticipated in the NMS. Competitive producers in Northwestern Europe are expected to maintain or even increase their production.

Executive Summary

limited supply is forecast to revive cattle farming in the NMS

In 2007, elevated beef and milk prices slowed down the contraction of the EU cattle herd. The elevated beef prices are partly a result of restricted beef imports. The EU-25 increased imports by about 80,000 MT, but this was offset by the cutback of about 120,000 MT of beef imports into Bulgaria and Romania. During 2008, total EU imports are even expected to decline further as the European Commission (EC) strengthened the import requirements for Brazilian beef. The limited supply of beef on the European market is expected to reduce EU beef consumption as well as exports. A third anticipated effect is a revival of cattle farming in some of the NMS.

2006 Dairy herd contracted due to increased milk productivity

Stock, calf crop and slaughter numbers are updated with official Eurostat census figures. During 2006, the total EU cattle herd shrunk by 1.3 percent. The reduction was most prominent for the dairy cow herd, which decreased by more than half a million head. This trend is a result of increased milk productivity. The reduction of the beef herd was less significant, and not throughout all MS. The beef herd increased in France, Germany, the Benelux and most of the twelve New Member States (NMS).

2007 Cattle herd contraction is slowed down by elevated beef and milk prices

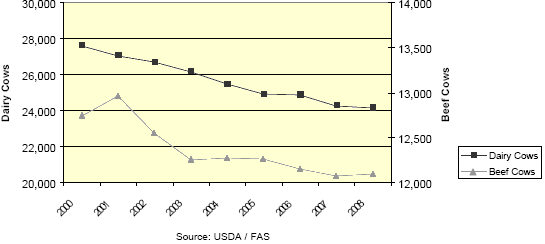

Based on Eurostat figures, the EU cattle herd is expected to have declined by 0.9 percent during 2007. The reduction of the dairy herd is slowed down by the high milk prices and the anticipated enlargement of milk quotas (see graph below). Expansion of the dairy herd is expected in Germany, the Benelux, the Iberian Peninsula and Poland. The effect of Blue Tongue Disease (BTD) on cow fertility, and thus on rebuilding the EU cattle stock is yet unclear. Expansion of the herd is mainly a result of farmers holding to their cattle, mostly dairy cows, but also young calves and heifers destined for dairy production. In Romania and Bulgaria (NMS-2), restructuring of the dairy sector was accelerated by the dry summer period and high feed costs. This increased slaughtering in the NMS-2 by 100,000 head, and reduced the dairy herd by 50,000 head. The total EU beef cattle herd is expected to have recovered slightly during 2007 (see graph below). During the end of 2007, producer sentiment changed as the increase in cattle and beef prices offset the high feed prices. The beef cow herd is expected to expand in France, the Benelux and the NMS. Cattle exports were hampered by BTD and the high domestic milk and carcass prices. The reduction in cattle loss results from the end of the removal of older cattle under the Over Thirty Month Scheme in the UK (see GAIN Report E47060).

(1,000 Head)

2008 In the NMS, the dairy and beef sector is forecast to revive

During 2008, shrinking of the cattle herd is expected to continue. But the pace of contraction is anticipated to slow down further. Calf production is forecast to recover in the NMS. This recovery is most prominent in Poland, where enlarged dairy quotas and the strong EU demand for beef is expected to revive the dairy and beef sector. Also, unprofitable hog production will force some Polish farmers to switch to cattle fattening. BTD and the high domestic cattle and milk prices are anticipated to have a continuous negative effect on cattle exports throughout 2008.

2007 The EU enlargement cut out 120,000 MT of beef imports in the NMS-2

In 2007, EU beef production is expected to have increased marginally. This temporary recovery is a consequence of increased slaughter weight in France, Germany, the UK and Ireland. In France, heavier beef cows were slaughtered and fewer calves and dairy cows. In Germany, the share of calf slaughter decreased compared to the share of adult cattle. In addition, German farmers held cattle longer in expectation of better prices. In the UK, cattle slaughter weight increased because slaughtering was hampered by Foot and Mouth Disease (FMD) related transport restrictions. Another factor for the increased beef production is the increased slaughtering in the NMS, in particular in Romania and Bulgaria. The temporary upturn in production only partly relieved the tight supply in the EU. The EU-25 increased imports by about 80,000 MT, but this was offset by the cutback of about 120,000 MT of beef imports into Bulgaria and Romania, as these NMS enforced the EU import regime. As a result, Brazilian beef exports to the EU were reduced from 533,000 MT in 2006 to about 445,000 MT in 2007 (see table below). Due to the tight supply, combined with the high Euro/US$ exchange rate and cuts of export refunds, EU beef exports decreased by a third. EU beef exports to Russia were reduced by more than half, and were replaced by Brazilian beef. Beef consumption rose slightly in those European markets that experienced an increased availability and moderate domestic prices, mainly in France and the UK.

(1,000 MT Carcass Weight)

2008 Unsecure import supply could further tighten domestic availability of beef

In line with reduced slaughtering, EU beef production is expected to decline after the temporary recovery in 2007. In the Annual Report (E47060), imports of mainly South- American beef were forecast to further increase, despite ongoing EC traceability and FMD concerns in the Brazilian beef export sector. At the mome nt, however, the Food and Veterinary Office (FVO) and the Government of Brazil (GOB) are in dialogue about the number of farms, that produce conform to EU requirements (see Policy Section of the report). In 2007, about 6,780 Brazilian farms were eligible to produce beef for the EU market. If in 2008, only about 100 to 700 farms regain their eligibility to produce for the EU market, European importers believe that Brazilian beef exports to the EU in 2008 will only be a fraction of the trade volume reached in 2007. But even if the FVO will relist all farms, importers expect the trade will not catch up with the volume reached in 2007. This assumption is partly based on the drop off in demand, which importers experienced as prices surged during the first two months of 2008. Following both scenarios, imports of fresh and frozen products, representing predominantly prime boneless cuts will be restricted. Imports of processed Brazilian beef are anticipated to increase only marginally (see also GAIN Report BR8605). Importers report that none of these beef products can be supplied by another producer in a sufficient volume. In anticipation of the decision of the FVO, importers roughly tripled their monthly import volume of frozen beef during January 2008. They reportedly sell this beef with good margins. Due to the limited availability of beef, and thus high domestic prices, EU beef exports are forecast to decline further (see also GAIN Report NL7032). In addition, the elevated prices are expected to signific antly reduce beef consumption throughout the entire EU. A third anticipated effect of the tight supply is that it will stimulate domestic beef production. This revival is expected to mainly take place in the NMS.

Policy

Trade dispute between Brazil and the EC

On December 19, 2007, the Standing Committee on the Food Chain and Animal Health (SCFCAH) approved a Commission Decision that imposes stricter traceability requirements for Brazilian beef exports to the EU (see GAIN Report E47112). On January 31, 2008, the EC imposed these requirements, which in practice banned Brazilian beef from the EU market (see GAIN Report E48016). At the moment, the European Food and Veterinary Office (FVO) and the Government of Brazil (GOB) are in negotiation about the number of farms that produce in conformance to the new EU requirements. On February 27, 2008, the FVO reportedly relisted about 100 farms as being eligible to produce for the EU market. This is only a fraction of the 6,780 Brazilian farms which were certified during 2007. The general expectation of the trade is that the FVO will relist in total about 700 farms during 2007.

Blue Tongue Disease (BTD) serotype 8 (see red zone in map above) has rapidly expanded in all directions during 2007. The EU sector hopes that vaccination of all susceptible animals in all infected Member States (MS) will allow bringing the disease under control in 2008. However, it seems that this strategy is questioned in some MS, even if the European Commission (EC) would agree to refund the purc hase of the vaccine. The fear is that, if vaccination is not comprehensive, the disease will spread further. Experts also fear that the virus might mutate as it starts to commingle with other virus types, as is occurring in the northern part of Spain. Opinions on the actual impact of BTD on cattle fertility and mortality rates, and hence beef and milk production, vary as little statistics are available yet. The damage consists of reduced growth, milk production and cow fertility, increased mortality, and cattle trade impediments. It is generally judged that on the longer term, decreased cow fertility will have a stronger impact on beef and milk production than increased cow mortality rates.

Further Reading

| - | You can view the full report, including tables, by clicking here. |

List of Articles in this series

To view our complete list of Livestock and Products Annual, and Semi-Annual reports, please click hereFebruary 2008