Rural Policy Centre Dairy Outlook for 2008

This is an extract from the Rural Policy Centre Outlook report for 2008 - a livestock assessment of global markets and UK prospects for the livestock sector, produced by Douglas Bell, Graham Kerr and Nick Sparks of the Scottish Agricultural College.Food production from livestock is the mainstay of Scottish agriculture. In terms of value, livestock products account for around 70 per cent of the industry’s production with livestock farmers producing approximately 400,000 tonnes of meat, 1.3 billion litres of milk and 850 million eggs per annum, in total worth over £1.1 billion. Livestock farming makes an important contribution to the nation’s economy in terms of food production, employment, rural infrastructure and environmental management. The outlook for this sector is therefore a key barometer for the whole industry.

Dairy

- The outlook is for continued growth in global demand.

- Improved commodity prices are now being achieved at the farm gate but higher feed costs are beginning to bite.

- Despite poor margins, restructuring and investment is continuing with many producers well placed to take advantage of the improved economic situation.

- New supply arrangements are bringing farmers, processors and retailers together.

- There is clear evidence that many in the industry are embracing the challenges of sustainability, but Water Framework and Nitrates restrictions represent a risk to economic business expansion.

- Maximising efficiency while adapting to market signals will continue to be the key to success.

Following a dramatic turnaround in fortunes driven by a world shortage of milk products and some successful lobbying by producer organisations, the outlook for the dairy industry is optimistic. Strong commodity price trends are now being reflected in price increases at the farm gate.

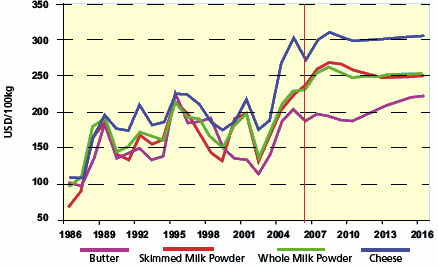

Projections suggest a continuing positive global supply/demand situation with world demand predicted to grow by more than 25 per cent by 2015, driven largely by increasing affluence and population growth in China and Southern Asia. World milk supply is currently restricted by climatic factors such as frequent droughts in Australia and production quotas in the European Union (EU). These restrictions, taken with a growth in demand, should translate into more attractive world prices over the short to medium term (Figure 1).

Movements in world prices for dairy products in nominal terms

Historically, the direct influence of the world market on the UK dairy industry has been limited. However, the recent convergence between world and EU prices means that European and British exporters can currently sell their products without relying on export refunds. Trade liberalisation is set to continue through Common Agricultural Policy (CAP) reform and the impact of World Trade Organisation (WTO) negotiations. Fluctuations in the world markets for milk products will therefore have an increased impact on the UK dairy industry. Against this backdrop, the ability of the EU and particularly the UK industry to take advantage of strong market demand, especially for value added products, will be critical to the future prosperity of dairy farmers.

In European terms, the UK dairy industry should be well placed to compete. A recent Dairy UK report indicates that our costs of production are amongst the lowest in the EU but still worryingly almost double that of Australia, New Zealand and interestingly Poland, whose contribution to EU milk production is now 8 per cent - only 2 per cent less than the UK. In Scotland, our larger herd size and predominance of successful management practices should give us the edge in UK terms.

Despite better prices, significant challenges still exist at individual farm level. In common with the rest of the livestock industry, dairy producers are facing significant increases in feed costs. Other production costs also continue to rise, especially those related to oil price, and for some, the need for reinvestment in infrastructure has become pressing. Additionally, some producers have still to tackle inefficiencies in their businesses, an issue that has been highlighted by benchmarking against top performers.

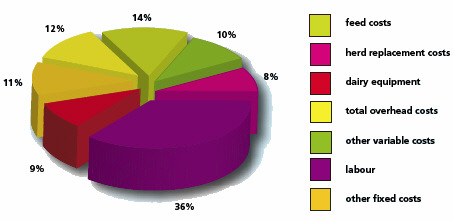

Percentage difference in costs per litre between highest and lowest cost herds

(Source: MDC)

(Source: MDC)Figure 2 highlights that the biggest discrepancy between high and low cost herds is in relation to labour costs. This suggests that the trend towards larger herds with modern facilities will continue as producers strive for efficiency. However, compliance with the Water Framework and Nitrates Directives may effectively cap herd sizes in the future.

In short, the future for the dairy sector is looking much brighter than of late but prudence suggests that surpluses generated at farm level now should be invested in restructuring businesses, adopting superior genetics and streamlining systems to maximise efficiency.

Further Reading

| - | You can view the full report by clicking here. |

March 2008