CoBank: US Dairy Producers Bolster Margins through Genetics

ANALYSIS - Due to the record-high beef prices in 2014-15, calf and cull cow sales provided a significant boost to dairies' margins, but this bonanza has ended, and dairies are looking to genetics to bolster their margins, according to CoBank's latest research report."In 2016, US dairy margins are being slugged with a 1-2 punch of soft milk prices and slashed cattle prices," said Trevor Amen, CoBank Animal Protein Economist. "Milk prices have now fallen 40 per cent from their high in late 2014. But until a few months ago, dairy producers were partially insulated from this painful decline due to record high cattle prices and lucrative sales of bull calves and cull cows."

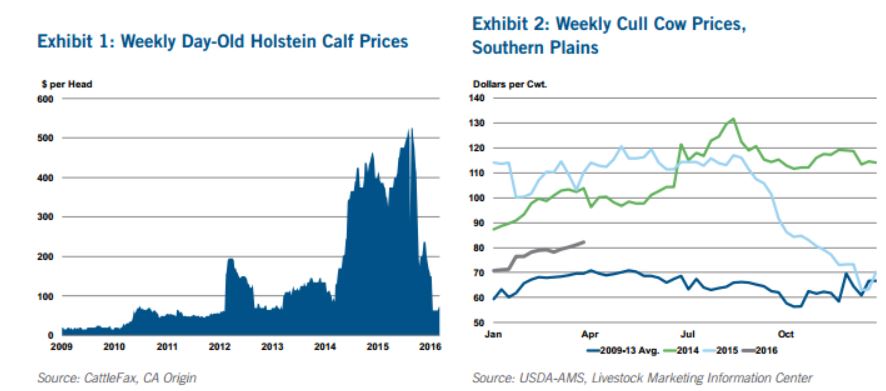

Dairies benefited substantially from historically tight beef supplies and record high beef prices. Now that calf and slaughter cow prices have retreated to their historical averages – down roughly 90 per cent and 40 per cent, respectively, from their 2015 highs – dairies are innovating to improve efficiencies and remain viable.

Following are the report's key takeaways:

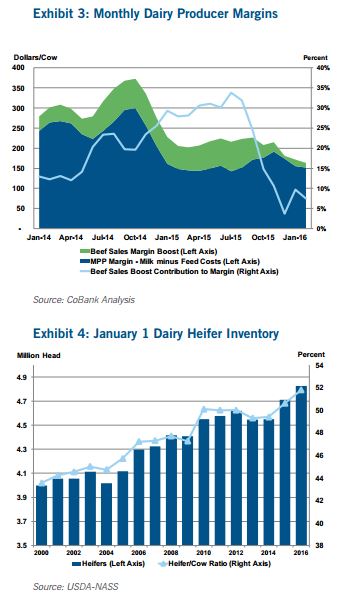

- The record-high cattle prices in 2014-15 spurred dairy farmers to increase the liquidation of older cows, leading to the youngest average dairy herd in history. Also, a younger mix of dairy heifers is contributing to ever-increasing herd productivity.

- The incremental revenue from sales of cull cows and bull calves boosted dairy margins by as much as one-third in mid-2015.

- By early 2016, cattle prices had plummeted, and the incremental revenue from sales of cull cows and bull calves had also evaporated, adding to the distress of dairy farms created by the sharply lower milk prices and margins.

- In the current environment, dairy producers are searching for ways to improve short-term cash flow and longer-term profitability. Toward these ends, dairies are turning to genetics and strategic alliances with the beef industry.

- Genetic tools such as sexed semen, genomic testing, in vitro fertilization, synchronization techniques, and herd management technology are less expensive today and are becoming much more common in today’s commercial dairies.

- Improved genetics are already boosting milk per cow, increasing fertility rates, improving calving ease, reducing still births, and enhancing calf quality.

- Genomic testing is being used to identify elite females for breeding, and crossbreeding dairy cows with proven beef sires is adding value to the bull calf crop. Higher quality beef traits are also enabling dairies to capture premiums in the beef market.

- Going forward, more dairies will adopt new genetic breeding programs, improving dairy production efficiency and adding value to both the dairy and beef cattle supply chains.

Price Swings Changing the Dairy Herd

Prior to 2014, the revenue received for cull cows and bull calves contributed very little to dairy producer margins. However, in an environment of high beef prices in 2014-15, calf and cull cow sales provided a significant boost to margins. Our analysis suggests that the incremental revenue from the sale of cull cows and bull calves contributed as much as one-third to dairy producers’ total margins in mid-2015. In early 2016, this benefit has evaporated, now contributing less than 10 per cent to total margins.

This swing in prices has affected the dairy herd in two distinct ways. First, while cull cow prices were high, dairy producers were incentivized to increase the liquidation of older cows. More aggressive culling has now led to the youngest average dairy herd in history. The dairy heifer to cow ratio has accelerated to a record high of 52 per cent, as of January 2016. A younger mix of females is contributing to ever-increasing productivity of the US dairy herd.

The second effect will take shape through the remainder of 2016 and beyond as a result of the collapse in cattle prices. More than ever, dairy producers are searching for ways to improve short term cash flow and long term profitability. As a result, dairy producers are increasingly turning to genetics and strategic alliances with the beef industry to improve operational efficiencies and create additional revenue streams.

Enhancing Margins Through Better Breeding

Enhancing Margins Through Better Breeding

When milk and cattle prices reduce dairy profitability to breakeven or below, as in the current market, producers are left with two ways to bolster margins: increase milk productivity and/or obtain higher premiums for bull calf sales. Recent advances in genetics make both of these possible, and at a much more affordable cost than in years past.

When the combination of elevated dairy and beef prices lifted margins well above breakeven, advanced genetics were a luxury for many operations. Today that is changing. Genetic tools such as sexed semen, genomic testing, in vitro fertilization, synchronization techniques, and management software technology are all much less expensive than they were five years ago, and they can provide much needed advantages for commercial dairies.

Through recent genomic advancements and downstream supply chain partnerships, commercial dairy producers now have the opportunity to develop a comprehensive breeding strategy as well as a bull calf marketing program. Genomic testing is used to identify elite females for breeding, and crossbreeding dairy cows with proven beef sires adds value to the bull calf crop.

Improved genetics are boosting milk per cow productivity at a faster rate, increasing fertility rates, improving calving ease, reducing still births, and enhancing calf quality. Higher quality beef traits are also enabling dairies to capture premiums in the beef market. A typical arrangement includes a calf grower or feedyard that contracts with a dairy to purchase dairy beef calves at a premium price to the Holstein calf market.

This contract also reduces risk for the dairy producer by solidifying a consistent market and price for bull calves. This consistency allows the dairy producer to plan and manage the finances of the operation more effectively. In turn, calf growers and feedyard operators benefit from higher quality beef from dairy cows, as well as improved health, growth rates, feed efficiency and carcass merit.

Integrated beef systems also make it easier to source and age verify the cattle.

Conclusion

Genetic advancements and breeding programs can offer dairy producers distinct advantages, particularly in today’s market. Breeding programs should be customized for each operation, and may not work for all dairy producers. Key considerations include dairy herd growth plans,

replacement strategy, genetic development optimization and excess calf marketing plans.

Much of the dairy industry is adopting new breeding programs which will continue to improve production efficiencies and add value to both the dairy and beef cattle supply chains.