CoBank: Protein Markets Benefit from Low Feed Costs, But Supplies, Exports Are Concern

ANALYSIS - The animal protein and dairy industries continue to benefit from lower feed costs, but building protein supplies and weak export markets are a concern, according to CoBank’s quarterly economic report.Domestic consumer demand remains solid but supplies could build domestically if export market conditions were to deteriorate. The protein markets would welcome another large grains and oilseed harvest.

Record high animal protein production levels are expected to pressure meat prices downward in 2016. However, the protein markets are in transition from a supply-dominated environment that compressed prices and margins in the closing months of 2015 to one with a better overall balance of supply and demand fundamentals.

The pace of this transition is largely dependent on demand pull-through, from both domestic and international consumers.

Beef Inventory Expanding

The beef industry is expanding at a brisk pace. USDA’s annual cattle inventory report, released in late January, revealed that every class of cattle posted inventory growth in 2015.

The beef cow herd increased 4 per cent. The number of heifers for beef cow replacements grew 3 per cent, and those heifers expected to calve in 2016 increased by 6 per cent.

With excellent pasture and range conditions, all regions of the country are now expanding their breeding female inventories. Restocking efforts in the Southern Plains region provided the biggest gain to the overall beef cow herd.

These aggressive herd-expansion efforts will lead to larger available supplies of cattle going forward. In turn, increases in beef production will start to show up in the market in mid-to-late 2016, and gain traction into 2017. Those increases in production will create downward pressure on prices for the cattle complex from now until possibly the end of the decade.

Cow/calf producers will dictate the pace of herd expansion moving forward. Heifer retention decisions will be influenced by pasture moisture conditions and profitability.

Analysts at the Livestock Marketing Information Center (LMIC) project average cow/calf returns in 2016 at just above $200 per cow – a decent rate of return historically and enough to fuel continued expansion, but below the sky-high returns posted in the last two years. Heifer retention decisions in 2016 are expected to have major impacts on the overall level of feedyard placements and also on future production growth.

Beef production is up 0.5 per cent in the year to date, reflecting a 1.1 per cent decrease in slaughter and a bigger increase in weights.

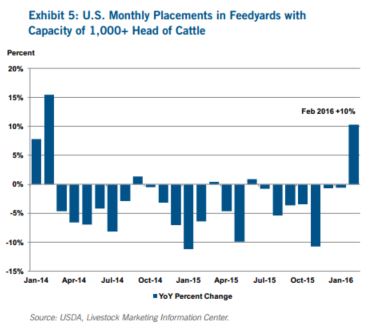

Placements posted a year-on-year gain in February for the first time in several years; and they are projected to build momentum over the second half of the year, resulting in an increase of 3-4 per cent for all of 2016.

Cattle feeders are anticipating a more hospitable business environment in the coming year, following last year’s major challenges.

With prices hastily retreating from their record cyclical highs in late 2014, feeders had few opportunities to place favourable breakevens during 2015.

But market conditions took a turn for the better in early 2016, with hedgeable profit opportunities beginning to open up. Going forward, steady increases in the availability of feeder cattle will provide much needed improvements in capacity utilisation for the feedyard sector. Development and proper execution of a sound risk management plan, however, will be paramount to the success of cattle feeders in 2016.

Beef packers posted counter-seasonal positive margins in the first few weeks of 2016, caused by a rally in the beef cutout value that surpassed the one in the live cattle market.

In coming months, beef cutout prices are expected to follow their normal seasonal patterns, having bottomed in February and gaining strength through the spring as the summer grilling season approaches.

In the short term, cattle feeders will continue to control the upper-hand over packers simply due to tight fed cattle supplies.

Higher slaughter levels in the coming months will provide a much needed boost in capacity utilisation for packers and should also shift the balance giving packers more favourable leverage over feedyards.

The magnitude of this shift will be largely dependent on the level of consumer demand. The expectation of tempered levels of volatility is supportive of a positive margin outlook for beef packers in 2016.

Beef Exports

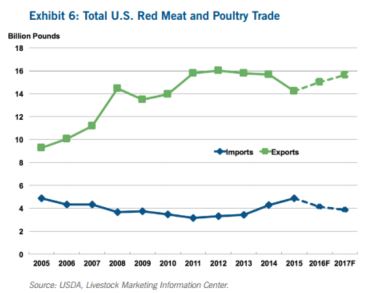

Due to declining beef prices, the US Meat Export Federation estimated that the beef export value per head of fed slaughter fell 11 per cent year-on-year in January.

For all of 2016, beef exports are projected to increase 3 per cent from the depressed levels experienced in 2015.

The recent slowdown in Australian beef production provides the US industry with an opportunity to regain market share among international buyers.

Likewise, lower Australian production and a normalisation of cow slaughter in the US contributed to the sizeable slowdown in 2016 so far in the volume of beef imported to the US, and these imports are projected to decline by 15 per cent in 2016. The shift back to a more favourable trade balance is expected to temper per capita supply growth.